Hopefully nobody comes to snouts-in-the-trough.com in order to be cheered up. If you do, then today is going to be very disappointing indeed.

If you’re a student now, you’ll probably leave university with about �44,000 in debt. With the Government slapping on a usurious above-inflation interest rate on that debt, the average student will end up paying close to �66,000 in the 30 years they pay off their debt till the remaining amount is written off.

So, if you get a decent job earning above �21,000 a year, you could easily be paying off around �2,000 a year. Doesn’t seem like too much, does it? But there are also some other debts you’ll have to pay off.

Our national debt is now about �1.5trn and will easily hit �1.8trn within the next 3 years as we’re still borrowing about �90bn a year. We currently pay about �60bn in interest each year on this debt. With around 30 million taxpayers, that’s about �2,000 a year per taxpayer.

So, now we’re at �4,000 a year you’ll have to pay for the rest of your working life.

But there are many other things you’ll be paying for which may not benefit you directly:

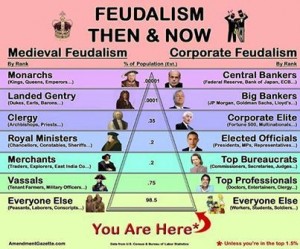

1. The ruling elites: We no longer have a democratic free market economy. Instead, a small elite of politicians, bureaucrats and bankers have amassed massive power for themselves and are able to siphon off huge quantities of our money. They’ll expect you to support their luxury lifestyles. How much are they thieving? �10bn a year? �20bn a year? I don’t know. But if it’s just �10bn, then you’ll be handing over around �300 a year to them (click to see more clearly)

2. The system gamers: Millions of people, especially immigrants and more especially those from the Religion of Peace, have learnt how to game the system so that they can live well – benefits, housing, free healthcare, free schooling etc – at the expense of those who choose to work. Let’s assume there are about 3 million of these parasites and they’re costing us �60bn a year (�20,000 a year each in benefits, housing and public services), then that’s �2,000 a year you’ll have to contribute to subsidise their lives of leisure

3. Foreign aid: Over �12bn a year is poured into the waiting offshore bank accounts of African and other Third World kleptocrats. With 30 million taxpayers, you’ll be forking out �400 per year to pay for the foreign aid farce

4. The EU: Last but not least, there’s around �19bn a year thrown into that large undemocratic black hole of greed and incompetence called the EU. Your share of this will be over �600 a year

So, it all mounts up: �2,000/yr for your student debt; �2,000/yr interest on the national debt; �300/yr for the elites; �2,000/yr for the system gamers; �400/yr for the foreign aid farce and �600/yr to the EU. That’s about �7,300/yr you’ll be paying in interest and to support various freeloaders and spongers.

Then you might want to buy a home. You might even need a mortgage. The average UK mortgage repayment is about �7,207 per year. Ooops, that’s even more debt you have to repay – hopefully you’ll have a little left over for your own food, clothing, holidays and entertainment?

Welcome to a life of debt slavery!

(For new readers, you can leave a comment or read comments by clicking on the headline)

(By the way, hopefully readers noticed the story of the 92-year-old woman who committed suicide partly due to being overwhelmed and impoverished by begging letters from charities. A couple of years ago, I noticed how my 88-year-old mother was being hounded and harassed by charities. That led to me researching Britain’s bloated, self-serving charity industry and writing my short book THE GREAT CHARITY SCANDAL)

I seem to recall that a number of student debt slaves filed for Bankruptcy and is a consequence would not spend years paying it off.

What is the position of those who have genuine commercial skills say engineering who could simply move to other EU states or say Australia. Does the state still try and collect the money owed? Or is this just driving skilled people away.

In theory, you have to keep paying your loan back even if you move abroad. But it seems the Student Loans Company is having great difficulty tracking people who leave Britain http://www.theguardian.com/higher-education-network/blog/2014/jul/28/graduates-move-abroad-pay-back-student-loan

Australia, which has a similar loans system is losing hundreds of millions as their students move to Europe and the US

Also another trick is to work in a lower-wage country so you never hit the �21,000 where repayments start, yet you can still live extremely well.

So, the short answer is “yes, large debts are likely to encourage students to leave Britain after graduating”

Old people and students should move to Scotland and there President Nicola

Sturgeon will look after us.

David Craig: Today they can’t track you but tomorrow….. one day when you’re 60 years old, you’ll get a knock on the door (with interest and late payment fines) ….. there goes the house.

…Also, so you go to college to earn UNDER �21,000 – that’s a good plan.