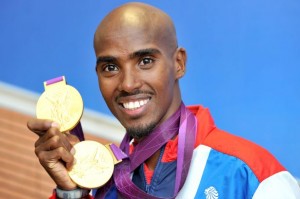

Today the great British Olympian Mo Farah OBE�will be running the London Marathon. Oh, how the enthusiastic crowds will cheer him on. And how TV reporters will blether on about how much we all love Mo, with his cheeky smile and his ‘Mobot’ gesture. But does Mo love us quite as much as we love him?

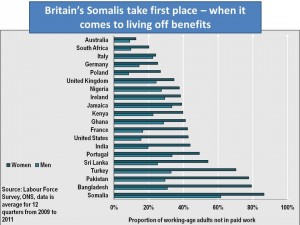

I’ve already written about the glaring scandal of Britain’s 250,000+ Somali community of which over 80% are what we politely call ‘economically inactive’ -�figures from the Guardian and the ONS (click to see more clearly)

Actually, there are probably a lot more than 250,000 Somalis here because a few years ago the Dutch government clamped down on benefits-scrounging by Somalis. So, many thousands moved to Britain for an easier and more lucrative life here doing nothing at someone else’s expense. Most will be classed as EU citizens as�they hold Dutch passports.

Britain’s Somalis probably cost us well over �2.5bn a year in benefits, housing education, healthcare and policing. This�is something that the media (especially the BBC) and politicians don’t often mention when telling us how good immigration is for Britain. If they do mention the Somalis, usually the story�is about how Britain’s generous Somalis send around �100m a year to their extended families back in Somalia. Though given how few Somalis actually work, one might wonder where (benefits? crime?) that �100m comes from.

But there is one bright light in this costly multicultural disaster – Mo Farah OBE. Mo was born in war-torn Somalia, but moved to Britain aged eight. And Britain has been good for Mo. I don’t know how much he’s cost us for his trainers and physiotherapists and sports psychologists and all the other things that have enabled him to achieve 2 Olympic gold medals.

A few million pounds? Probably. But wasn’t it worth it when we saw Mo proudly running along after his victories holding the British flag?

And anyway, with Mo Farah projected to earn over �10m in the next few years, we’ll surely get some of that money back in taxes from Mo to show his gratitude about how well Britain has treated him? Umm, well, maybe not. You see our Mo has reportedly recently applied to HMRC to change his place of residence from Britain to the US and this will save him millions in tax.

The athlete, who lives in Teddington, London, has continually spoken of his pride at representing Britain. He once said: �It�s where I grew up. I don�t know nothing but England.� But his non-residency �application names Portland, Oregon � where he trains � as his main home with wife Tania, her daughter Rihanna and their 17-month-old twins Aisha and Amani.

He has sponsorship deals with Virgin Media, Quorn, Lucozade and Nike, earning him millions and gets about �250,000 a time for running in exhibition events. Mo was paid �250,000 for running only half last year�s London Marathon. I imagine he’ll be getting as much, if not more, for running the full London Marathon today. But if his claim�to live in the US is accepted by HMRC, not much of Mo Farah’s huge income will go to the British taxman.

Run, Mo, run! Away from the British taxman!

I always use the old adage that we would all do it if we could. He has been out in Portland for a few years now so how he’s only just cottoned on to this tax dodge must mean he’s only just taken on an accountant who has advised him to do this…

But it does seem a bit off taking all that lotery funding e.c.t and not putting anything back in when one hits the big time…

Why is he even eligable to run for the UK, he didn’t come to treasure island until he was eight. What a perverse world we live in.

Surely his tax residency will be a matter of fact and not choice if he spending little time in the UK and becomes a US tax resident by virtue of the time spent there each year? And the US is not exactly a tax haven! They have 40% rate on high earners.

If he had moved to (or claimed residence of) Bermuda or British Vigin Islands or even the Isle of Man, you might have a point.