One of my readers contacted me asking what really happens when our banks get fined for rate-rigging, money-laundering, market manipulation and all the other things that they’ve been up to over the last few years. The answer is simple – we’re the ones who end up paying.

You’ve probably read about Barclays being fined $450m by US and UK regulators for LIBOR rate fixing: HSBC being fined $1.9bn in the US for money-laundering and �3.6bn in the UK for mis-selling products and JP Morgan agreeing a $13bn settlement in the US for mis-selling mortgage securities. And you may have thought that this serves them right, that it was about time our greedy, corrupt bankers paid for their own crimes. But who actually pays this money? Is it the bankers who were responsible in the first place? Can pigs fly at supersonic speed?

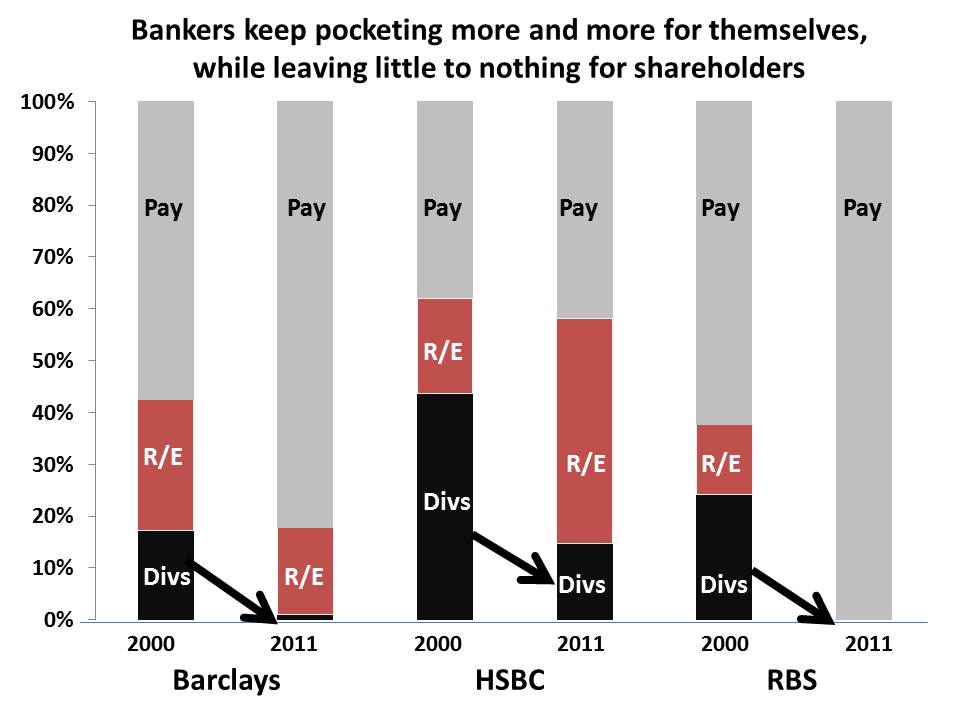

Banks have�3 main things they can do with their earnings – pay salaries and bonuses to their staff, retain them to build their businesses or pay them out as dividends to shareholders. This brings up what’s called the “Agency Problem”. The theoretical owners of banks (like all public companies) are the shareholders. The executives and managers are the owners’ agents who should supposedly run the businesses in the long-term interests of the owners (the shareholders). But in many of our companies and all of our banks, the companies have been hijacked by the agents (executives and managers) who run them for their own short-term rapid enrichment and to hell with the shareholders.

The chart below shows how at 3 major banks, dividends paid to shareholders have all but evaporated since 2000 and retained earnings have shrunk at two of them,�while salaries and bonuses paid to bankers keep on increasing.

(The reason why retained earnings rocketed at HSBC was that the bank was keeping money back from shareholders to pay some of the massive fines it knew were coming)

HSBC is a good example of how bankers have partied while screwing their shareholders. HSBC had to pay record fines in 2012 of $4.2bn. Yet the CEO’s�remuneration shot up from $10.6m in 2011 to $14.1m in 2012. So, he didn’t suffer too much from the corruption for which as CEO he was ultimately responsible.

The picture has been the same at most other banks – the bosses and managers keep giving themselves more, while making the owners (the shareholders) pay for the managers’ corruption and incompetence. And who are the banks’ main shareholders? Rich, greedy capitalists? No. They’re usually you and I through the money we’ve saved in unit trusts and pension funds. The bankers stray, we pay.

But the situation is even worse than this. By offering to such huge fines without hesitation, the bankers are also getting the authorities to agree to drop all criminal proceeding against them. So, they are using shareholders’ money (our money) both to pay for their own misdeeds and to buy themselves immunity from prosecution. Amazingly, this is something not a single financial journalist has thought worth mentioning.

Moreover, our politicians of all parties have been huffing and puffing in self-righteous indignation about the police who probably lied over the Plabgate affair. But we haven’t heard them demanding the prosecution of any bankers. To paraphrase someone much more intelligent than myself – “the only difference between the three main political parties is the speed at which their knees hit the floor when a banker comes demanding favours”.

�

Christmas is coming. Is there anyone you dislike and want to depress? Well, why not give them a copy of my latest book GREED UNLIMITED? I have rather a lot left and my wife might start burning them to heat up our home this winter (and reduce our energy bills) if I don’t sell some soon.

Where is the power of the shareholders’ votes?

Because President Barack Obama and the leaders of both political parties are unwilling to address the housing crisis and the wasting effects on the largest banks, I am equally afraid there will be no growth and no net job creation in the U.S. for the next several years.

And because the Obama White House is content to ignore the crisis facing millions of American homeowners, who are deep underwater and will eventually default on their loans, the efforts by the Fed to reflate the U.S. economy and particularly consumer spending will be futile.

This is not a monetary problem. The policy of the Fed and Treasury with respect to the large banks is state socialism writ large, without even the pretense of a greater public good.

The fraud and obfuscation now underway in Washington to protect the TBTF banks and GSEs totals into the trillions of dollars and rises to the level of treason.