Most people putting money into things like unit trusts and pensions expect their savings to grow over time. After all, the Money sections of the weekend papers are full of articles and ads about the best places to put our money. Surely all the personal finance journalists and financial services companies can’t be lying? Can they?

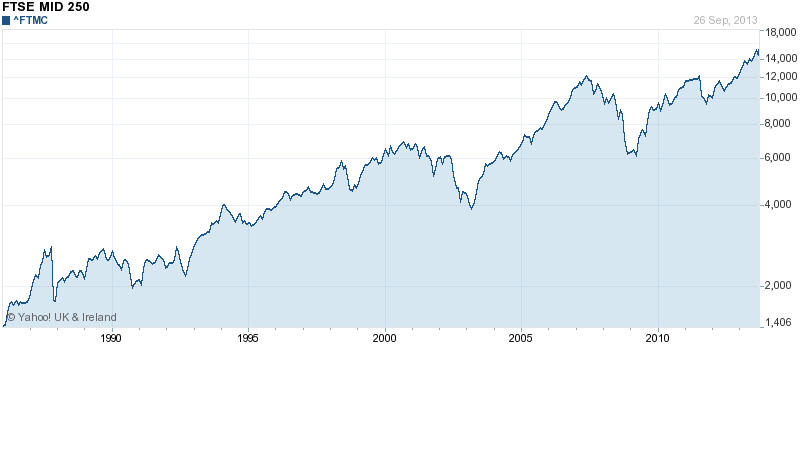

Here’s a typical chart of share prices:

Looking at this, it seems that shares are a fairly safe bet if you want your money (in unit trusts or pensions) to grow in value.

But once you factor in inflation, things start to look a lot different:

This chart is really important for at least�4 reasons:

1. Stock markets don’t go up Although financial journalists are forever writing gushing articles about how stock markets are moving to new highs, this is usually total bunkum. It’s rubbish, because these journalists never bother factoring in the effects of inflation. But look at the top line on the chart. This�shows the real (inflation-adjusted) value of UK shares. There was a wonderful period of real growth during the 1990s. But since 2000, the value of UK shares has been on a downward trajectory. The supposed “pundits” witter on that the FTSE 100 could reach maybe 7000 by the end of the year as if this was great news for us savers. Actually, the FTSE 100 would probably have to go up to 8500 or even 9000 (which is NOT going to happen) to make up the losses made since 2000

2. Beware the baby-boomer effect Look at the green and red lines on the chart. They represent the shares held by British savers either as individuals or in unit trusts and pension funds. Both the green and red lines are going down. But why? You will never hear this from a financial adviser or journalist, but what I believe we’re seeing is the “baby-boomer effect”. During the 1980s and 1990s the richest generation ever to live in Britain – the baby-boomers – were busy putting their savings into unit trusts and pension funds. This boosted demand for shares and so pushed up prices. But as the baby-boomers retire and move their money from pension funds to annuity companies (which tend to buy government bonds) there will be a massive withdrawal of baby-boomer money from worldwide stock markets and a fall in prices. The US General Accounting Office were so concerned that they did a study to estimate how much stock markets would fall. They�concluded there was no reason for savers to panic. When a government department says there’s no reason to panic, that’s usually a good reason to panic.

3. Flood of foreign money Now look at the blue line – foreign ownership of UK shares has shot up.�I believe this shows the massive rise in wealth in Asian countries. Asian savers need somewhere to put their money. Most Asian stock markets are thoroughly corrupt – the Wild East of investing. So, if Asian savers are looking for a safe haven for their money, they’ll gravitate to Western stock markets and in particular well-run Western companies that do a lot of their business in growing parts of the world like Asia. So these savers get the benefits of Asian growth without the risks of the corrupt Asian stock markets. The inflow of Asian money will partly offset the withdrawal of baby-boomer money. But so far, the Asian money has not been sufficient to support markets.

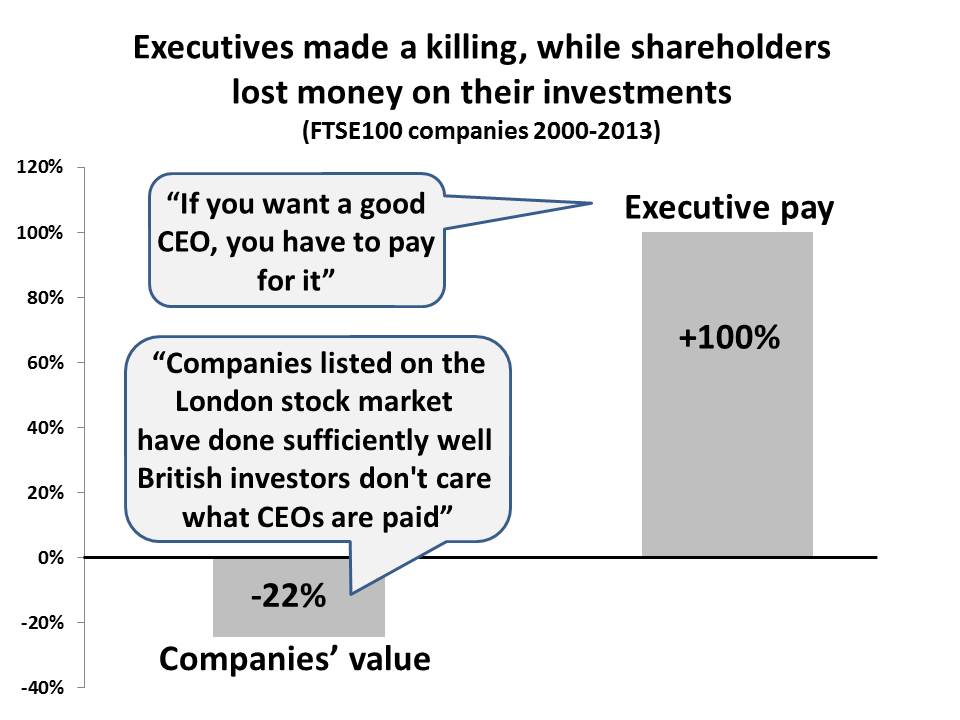

4. The greed of British CEOs Looking again at the top line on the chart, we can see that the value of UK companies has been falling. Yet at the same time, CEOs of British companies have been massively increasing their own salaries and bonuses.

In the last 13 years, the share prices of the FTSE 100 companies have fallen by over 20%. But, while claiming they cannot afford to pay their employees reasonable salaries, the companies’ CEOs have doubled their own remuneration. Our CEOs are having a very lucrative laugh – at our expense.

(click on title to comment or to leave a comment)

You would have to be mad to put your money in the stock market now, nothing but a ponzi scheme propped up by QE money printing.

For the same reasons the Bank of England have increased the employer pension contribution to 57.3% of pay – more than their take-home pay. See http://www.bankofengland.co.uk/about/Documents/humanresources/pensionreport.

pdf