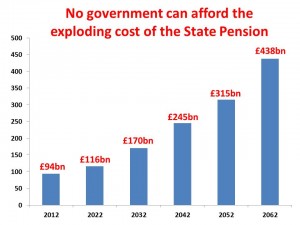

The cost of paying out the State Pension is around �94bn a year now. When you include other benefits paid to pensioners, the total cost is �110bn a year. The cost of the State Pension and benefits paid to pensioners are expected to more than quadruple in the next 50 years (click to see more clearly)

Yup, according to the Office for National Statistics, by 2062 the cost of the State Pension will be �438bn a year and total benefits paid to pensioners an eye-watering �491bn a year.

You don’t have to be an economic genius to see that no government which is taking in about �700bn a year in tax revenues can afford to pay over �400bn of its revenues just to pensioners.

So, what’s going to happen? This is how our leaders will avoid paying a pension to most of us:

Step 1 � Introduce auto-enrolment for the Workplace Pension. This is already�happening with 2.9 million workers in larger companies already signed up and millions more in smaller companies set to join over the next couple of years all paying about 8% (including employer contributions and tax rebates)

Step 2 � Once people get used to paying into a pension, move the goal posts � make paying about 6% compulsory and then auto-enrolling us to pay another 4% to 6% � voluntarily��because the 8% of the current Workplace Pension was not sufficient to provide most people�s pensions

Step 3 � Cut the link between years of NI contributions and entitlement to the state pension, so that the state pension becomes a �benefit� (like unemployment benefit) rather than an �entitlement� based on years of NI contributions

Step 4 � Once the state pension�becomes a benefit, not an entitlement, only those with little to no pension savings will get the state pension

This means that, for anyone earning less than say �20,000,�every pound they save into a pension scheme will result in reducing their eligibility for the state pension. They are being suckered. In fact, unless you’re going to be able to save at least �200,000 into your pension pot, it’s probably not worth saving anything at all.

In the meantime, our rulers will�keep on increasing the age at which the state pension will be paid to us, while preserving their own early retirement opportunities.

This move towards compulsory saving and abolition of the state pension for all but the very poor will happen over several years � maybe 15 to 20. But it will happen as the state pension is becoming ever more unaffordable.

Oh, and to really cheer everybody up, here’s the National Debt Clock http://www.nationaldebtclock.co.uk/�Aaaaaarrrrrghggggghhhhh!

http://www.nationaldebtclock.co.uk/

Not looking good, is it?

The solutions have been mentioned here several times.

For starters,

Stop Foreign Aid

No more EUSSR subs

Bonfire of the Quangos

Massive overhaul of our welfare system.

Get the professional tax avoiders like Google, etc to pay their fair share. Deliver an ultimatum

“We don’t care how clever your accountants/tax lawyers are but if you want to trade over here you will pay a turnover tax. Take it or leave it”

And, it goes without saying, stop importing welfare dependent immigrants (start deporting them) and keep our noses out of other countries’ conflicts.

@Paris…

Turnover tax… Like it!

I remember Gordon Browns 75p a week increase in state pension in 2000…… pensioners rejoiced……but could not forget that Gordon Brown also stole �5 billion a year from peoples private pensions…to fund the pensions of the public sector . In 2008, there were 17,000 retired Public Sector employees with retirement benefits of over �1 million each, while unfunded public sector pensions liabilities were estimated at �1 trillion….more than 70% of GDP. We all know what successive governments think of the pensioner, it would suit them if people dropped dead on reaching retirement age, so the money saved can go to more deserving case �50 million a day to be a member of the EU club

http://www.taxpayersalliance.com/economics/2008/11/new-research-pe.html

Peter, I think I got the idea from DC (not David Cameron!) on this site

Here’s a link to the post where I propose scrapping Corporation Tax and replacing it by a turnover tax http://www.snouts-in-the-trough.com/archives/3497