Do you have any money saved up in unit trusts? If so,�do you have any idea how much you’re paying each year in charges? Probably not.

Many people think that the Annual Management Charge (AMC) is all they’re paying. AMCs for the 2,000 or so UK-based unit trusts are around 1.1%.

Some people have understood that they pay more than the AMC. They probably think that what they’re paying is the Total Expense Ratio (TER). The TER includes the AMC plus a few other costs and averages about 1.6%. Please note that in the US, where the market is more competitive,�the TER averages just 0.98% – an awful lot lower than in the UK.

Now, you might think that something with the word ‘total’ in it means that is all you’ll pay. And in fact, surveys have shown that the majority of savers believe they’re either paying just the AMC or the TER.

But there are a whole lot of costs not included in the TER. The biggest of these is probably the cost of your unit trust manager buying and selling shares. On average this adds another 0.6%. So, that takes your cost up to around 2.2%. Then there are a few other ‘hidden costs’ which mean that a unit trust with a TER of 1.6% can actually be costing you anywhere from 2.75% to 3.2%.

Now you may be thinking: ‘well 2.75% to 3.2% doesn’t sound too bad’. If so, you’d be awfully wrong.

The total annual return on UK stock markets over the last 110 years has been about 5.2%. But this is pushed up by returns of 8% to 10% during the 1980s and 1990s (click to see more clearly)

So when you take out those years,�factor in�that all unit trusts will hold some cash so can never achieve the performance of the overall market�and account for the fact that tax is automatically deducted from dividends paid to your unit trust, you can expect returns of about 4% a year at most from an average unit trust.

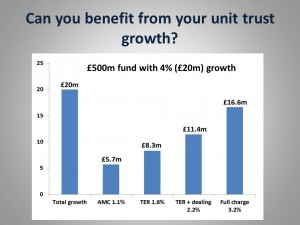

Here comes the problem. While your unit trust may grow by 4% a year, you pay charges on the total amount of money in the unit trust (not on just the growth). This means that virtually all the supposed growth in your unit trust goes into the pockets of your unit trust manager (click to see more clearly)

So, if you had money in a �500m unit trust which grew by 4%, that would give the unit trust �20m. But with charges of 3.2%,�over �16m of this growth would be taken by your unit trust manager. That would leave �3.4m for unit trust savers – annual growth of a laughably paltry 0.8%.

On behalf of the multimillionaire members of the Investment Management Association, I’d like to thank you for your generosity.

Almost nobody sells pensions any more, the commission for the(low level) salesman is somewhere between crap and non existent. The market place for pension transfers is very buoyant and lucrative, it just involves moving money around from provider A to provider B.

You don’t seem to understand the concept of a REAL return.

Your own chart, which has no source, shows a 4% REAL return (after inflation). Your conclusions then assume a 4% NOMINAL return (including inflation).

A re-write seems to be in order.