If I can make a sweeping generalisation, I�d suggest that those households that pay more in taxes than they receive in services (the givers) are likely to be against ever-increasing government spending, a bloated overpaid, over-pensioned public sector and massively expensive corrupt institutions like the EU. Whereas those households which receive more from the government than they pay in taxes (the takers) will support large government and increased public-spending � after all, the more the government spends, the more they get and the better off they are.

At some point under New Labour (probably around 2005) Britain reached a very important �tipping point�. The dictionary definition of a �tipping point� is The point at which a slow, reversible change becomes irreversible, often with dramatic consequences.

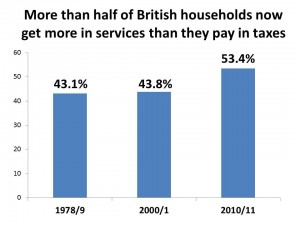

This tipping point was when Britain moved from a situation where the majority of households were �givers� paying more in tax (including direct taxes such as income tax and indirect taxes such as VAT, fuel and alcohol duties) than they got in services (including state spending on benefits in kind, such as the NHS and state education) to one where the majority of households became �takers� getting more in services than they pay in taxes. In 1978/9 around 43.1% of households were �takers�. By 2010/11 the �takers� had reached 53.4% of all households.

Now the percentage of �takers� is likely to be even higher.

This little-known figure – “takers” becoming a majority of households – has massive implications for Britain�s future. ��Takers� are likely to vote for ever-increasing borrowing and spending � after all, it�s not them who will have to pay the bills.

Many commentators have wondered how the useless, ludicrous schoolboy Red Ed Miliband and the (IMHO) financially-incontinent, deluded, sociopathic liar and buffoon Ed Balls can be leading in the opinion polls and headed for power in May 2015. Perhaps�”takers” becoming a majority�is the explanation. As the Americans would say, �there are more people in the wagon than are pulling it�. Then when you factor in that idiot Brown hugely expanded the public-sector bureaucracy, you have millions more who will see more spending and more borrowing as being to their personal advantage.

And then you have to also remember the massive scale of postal vote fraud in immigrant communities who will tend to vote Labour.

Oonce there are more �takers� than �givers� in a country, the majority will always vote for more money for themselves until the bring the country to its financial knees.

If I may re-use a quote I used a few days ago Alexander Fraser Tytler (1747-1813), �A democracy cannot exist as a permanent form of government. It can only exist until voters discover that they can vote themselves largesse from the Public Treasury. From that moment on, the majority always votes for the candidates promising the most benefits from the Public Treasury with the result that a democracy always collapses over loose fiscal policy, always followed by dictatorship�.

I suppose that the only hope for Britain is if enough of the �takers� are too lazy, indolent or stupid to go out and vote in 2015.

(By the way, a reader has told me that WordPress seems to be playing up and has changed the text size making it difficult to read. I’m trying to find a solution. Thanks for your patience)

[…] The shocking figure that suggests Britain cannot avoid financial ruin By��David Craig, on December 2nd, 2013 […]

The mail reported on a 31 year old woman with 8 half caste kids ( no mention of the father/fathers) who was whinging that her benefits had been cut from around �580pw to �500pw.Factor in other costs such as education and healthcare etc and she and her brood must be hovering up the tax paid by a dozen or so decent working people. Not that I want to see anyone starve, but something must be done to prevent such abuse.

http://www.dailymail.co.uk/news/article-2516745/I-survive-500-week-benefits-says-Birmingham-single-mother-eight.html

The father/fathers must have fallen out of the ugly tree and hit every branch on the way down.

Let me know if you can’t solve the font problem. You have my email address.

I’ll sort it for you. Gratis, obviously.