Hopefully most readers know that the Government’s Funding For Lending scheme is giving the banks loads of taxpayers’ cash at almost zero rates of interest in the hope the banks will lend our money back to us and so boost the economy. This means the banks no longer need our savings and so offer such pathetically low rates of interest on our cash deposits that, because of inflation, our money is losing value every day.

As savers desperately look for some way to beat inflation, this has given the banks a �wonderful opportunity to sell us supposed investment products. Many savers are risk-averse. They don’t want to risk their money on the stock market. So, the banks have created a new investment�scheme they call “structured products” to convince risk-averse savers to part with their money. The banks�sell them to us savers�using names�like “Guaranteed Growth Bonds” or “Guaranteed Investment Bonds” or something reassuring like that.

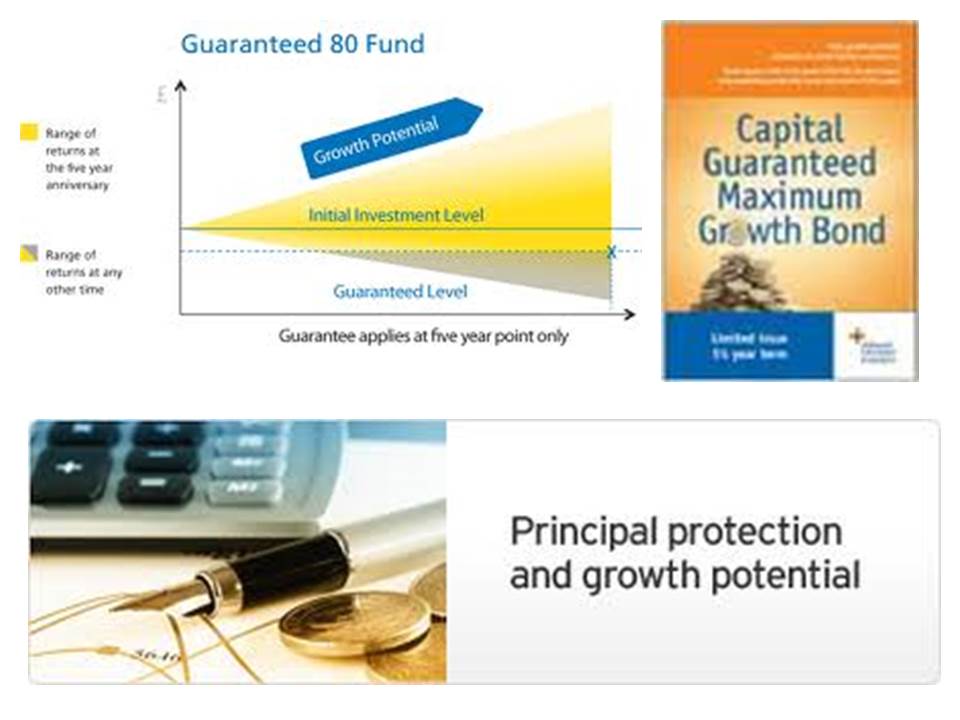

These bonds promise us 80% or 100% or even 120% of stock-market growth over 4 or 5 or 6 years. But they guarantee we get our capital back in full if the stock market falls a bit. This “guarantee” has attracted many risk-averse savers and we have put over �60bn into these dreadful products.

The sales pitch often used to convince financially-na�ve customers to put their savings into these schemes is something along the lines�”you get all the benefits of stock market investing without the risks”. But this is a lie.

Almost all the benefits of investing in shares come from the dividends paid by the companies whose shares you buy. But these guaranteed bonds usually don’t actually buy any shares. They are mostly linked to complex financial derivatives which track stock-market levels. And if they do actually buy shares, they don’t give the dividends to savers. Savers only benefit if the market index goes up. Moreover, often the guarantee only covers you up to�a certain level if the stock market does fall. If the stock market drops below that level, your losses can be horrendous.

So instead of giving “all the benefits of stock market investing without the risks”, these schemes actually�give you virtually none of the benefits of stock-market investing, with often huge risks. Don’t either you or anyone you know be taken in by this blatant lie.

And anyway, why would you trust one of our corrupt, bankrupt banks to give you financial advice?

[…] Since 2008/9, about �60bn of savers’ money has gone into investment products sold by banks and usually called something like “Guaranteed Growth Bonds” or “Guaranteed Investment Bonds”. I have previously explained why these are truly dreadful for savers but wonderful for the banks and City spivs who have created them http://www.snouts-in-the-trough.com/archives/7404 […]