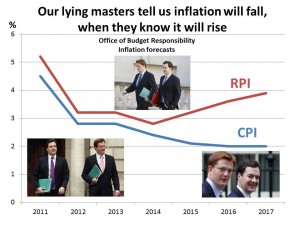

Our masters in Westminster claim that they have a target to bring inflation down to around 2%. But I’ve been flicking through the laughably-named Office for Budget Responsibility’s (OBR) 189-page Economic and Fiscal Outlook and found a very different story.

There are two main measures of inflation RPI (Retail Price Index) and CPI (Consumer Price Index). There are two�main differences between RPI and CPI. Firstly, RPI includes some things like housing, council tax, road tax and TV licence which are not in CPI. And secondly, the RPI is an “arithmetic” mean whereas the CPI is a “geometric” mean (explanation here http://www.significancemagazine.org/details/webexclusive/1314363/RPI-versus-CPI—The-Definitive-Account.html) Apparently this difference in the way of calculating inflation will always make the RPI around 1% higher than the CPI.

The supposedly independent OBR predicts that CPI will fall to the targeted 2% by 2016. Although, given that the Bank of England predicted achieving 2% every quarter for about�five years and never achieved this, we shouldn’t take the supinely subservient OBR’s forecast too seriously. But what is interesting is the Government’s, sorry I meant the OBR’s forecast for RPI. This is expected to go in exactly the opposite direction to CPI (see chart)

This rise is quite important for us. Firstly because inflation erodes the value of our savings. If we had �10,000 in 2010, according the CPI,�this would buy �8,280 worth of goods by 2017. However, using RPI, our �10,000 would only buy �7,740 of goods by 2017.

Moreover, when working out how much money to take from us or give back to us, the Government chooses whichever of the two inflation measures suits it best. So, when telling us how high inflation is, the government uses the lower CPI to make it look like they are in control of the economy. It also uses the lower CPI for the indexation of most tax rates, allowances and thresholds, in order to take more money from us, and for the uprating of benefits and public-sector pensions, in order to give less money to us. However, the Government uses the much higher RPI for things like student loan payments and the revalorisation of excise duties in order to get more money from us.

Oh, and thanks to a reader for pointing out that the Bank of England uses RPI (the higher index for inflation) when calculating what�its staff�should get each year with their pensions.

As for the supposedly “independent” OBR – for a financially-incontinent British government, that is doubling our national debt in just five years from �700bn�to �1.4trn, to create an “Office for Budget Responsibility” is a bit like Democratic People’s Republic of North Korea creating an Office for Freedom of Speech and Human Rights.

This is precisely what was happening under Brown. ‘Real’ inflation was going through he roof. We all know what happened. If something (like house price rises) looks unsustainable, it probably is.

See if you can guess which inflation measure the Bank of England uses for calculating its OWN pensions. I’ll give you a clue: ii’s the same one they downgrade and ignore because it is no longer “relevant”!