In 1979,�43.1% of total households received more in benefits (including state spending on benefits in kind, such as the NHS and state education) than they paid in taxes (including direct taxes such as income tax and indirect taxes such as VAT, fuel and alcohol duties).�In 2000/01, this figure was�43.8% and by�2010/11,�this had reached�53.4%

So, what’s happening? One reason for the increasing reliance on benefits is the behaviour of many large companies. Claiming that they’re competing in a global race or something like that, many companies�pay low wages, the minimum wage or even “zero hours contracts”. Then�taxpayers have�to subsidise these jobs with tax credits and other benefits so workers and their families�can afford to eat and have�somewhere to live (usually enriching buy-to-let landlords).

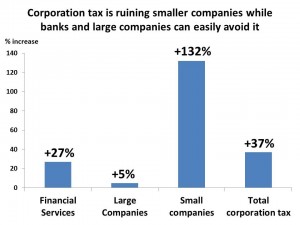

The Government’s need for money to pay so much in benefits to low-paid workers, of course, forces the Government to borrow more and tax more. But many large companies, who supposedly can’t afford to pay their workers decent wages, seem to be allergic to paying tax. So they set up complex arrangements using offshore tax havens to reduce or completely eliminate their tax liabilities. In the economic boom from 1997 to 2007, tax revenues from smaller companies (which can’t afford smart, expensive accountants) went up by 132%. But taxes paid by�financial services firms increased by only 27% and taxes from large companies by a pathetic 5% (see chart)

There are many factors causing our rush to national bankruptcy. One is the greed, incompetence and profligacy of our over-paid, over-pensioned political and bureaucratic classes. Another is the supposedly efficient private sector sucking the lifeblood out the UK by siphoning off our money into their foreign bank accounts. But it’s not the soldiers, sailors, nurses and firemen who are now losing their jobs�that are bankrupting Britain.

(Click on title to leave a comment or view comments)

The client state……the dream of all socialists. The so-called conservatives have had three years to reverse the trend, but have just made the problem worse. Are there no honourable conservatives prepared to stick their heads above the parapet and rid us of this statist?

The skim-off by the larger companies does appear to be a problem but I think it’s wrong to attach any blame to them.

Our government should be looking into WHY they are moving monies offshore in order to avoid taxation and then doing everything possible to ensure that they don’t.

The tax system in the UK is hopelessly complicated and I doubt that even high-up people who work in the tax office know even 50% of the actual rules.

It’s a mess. It needs dismantling and starting from scratch.

Businesses should not be paying tax. Tax should only be payable by individuals.

Mass immigration has fueled this situation, why pay the indiginouse population a liveable wage when you can employ a foreigner peanuts to do it. We are heading towards a second world status because of it. The only hope we have now is that manufacturing returns to this country as the China’s of this world become uneconomic for large companies to exploit.

Simplification of taxation and reduce overall tax levels via reduced state spending which has a too large generously paid staff which in reality cannot be financed other than by increased taxation on private sector.