Friday-weekend blog

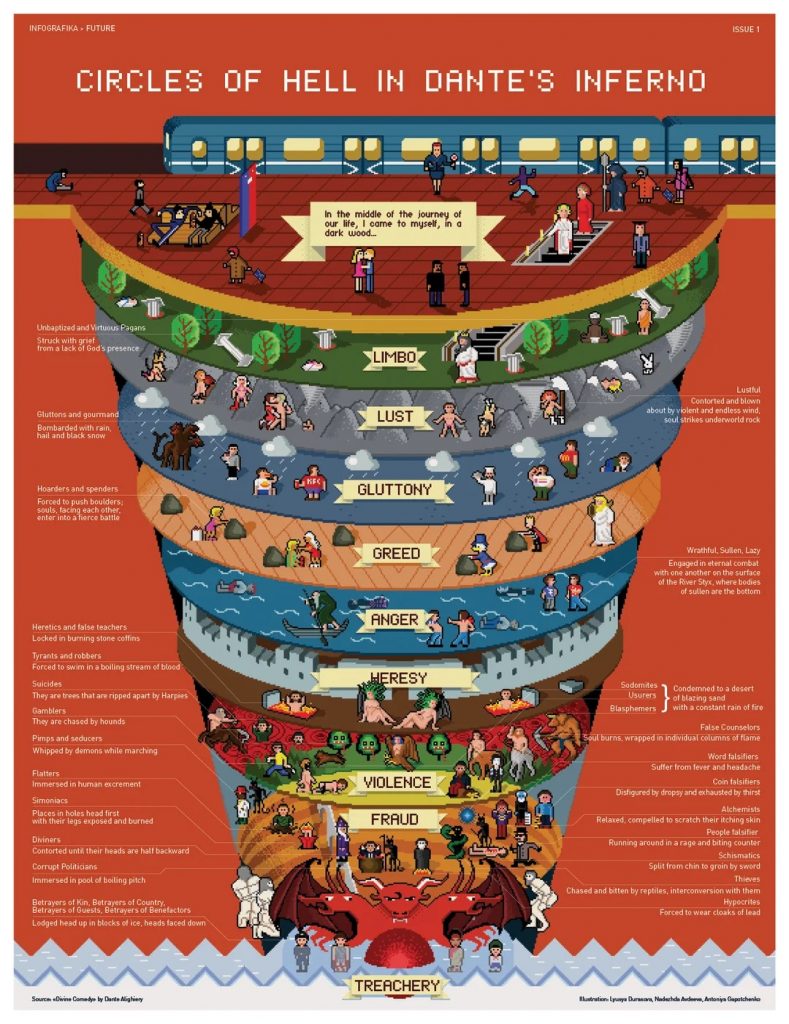

In the poem Dante’s Inferno, Hell is depicted as nine concentric circles of torment located within the Earth; it is the “realm […] of those who have rejected spiritual values by yielding to bestial appetites or violence, or by perverting their human intellect to fraud or malice against their fellowmen”:

I came across a chart I thought readers might find interesting. It’s from an excellent website called “The Visual Capitalist“. Ever week or so, the website publishes and emails out links to new charts depicting economic issues in strikingly visual ways. I highly recommend you subscribe to receiving their emails.

The latest chart shows different countries’ levels of debt set out in five circles. We could call these the “Five Circles of Debt Hell”

You’ll see that Britain with 104% of debt to GDP is in the third circle of debt hell along with countries like Spain, Senegal, France, Mozambique, Canada and others. Countries in the fourth circle of debt hell are countries like Italy, USA, Greece and, surprising to me, Singapore with debt levels of 130% to 150% to GDP. But I have checked and the Singapore figures are correct. I also find it odd that The Visual Capitalist has put Japan with debt level of 235% in the fourth circle of debt hell. I would have thought that, with a debt level of 235%, it belonged in the final circle of debt hell along with Sudan at 252%.

The main conclusion I draw from this is that few if any of the countries featured can ever actually pay off their debt. In fact, most of the countries are, as far as I understand, technically bankrupt. They can only ever afford to keep on paying the interest on their debt. But they will never be in a position to have a budget surplus which would allow them to start paying down their debt. Even worse, for many of these countries, such as the UK, their debt and thus interest payments, keep on increasing. After all, by giving our usually Labour-voting, often lazy, often unproductive and often incompetent UK public-sector employees repeated generous pay rises while our public services collapse and by encouraging tens of thousands of mostly uneducated, mostly unemployable, often criminal Third-Worlders to flood over our non-existent borders by giving them free 4-star hotel accommodation, free healthcare, free smartphones, free clothing, free money, free legal aid to avoid deportation, free everything, the UK is truly on the road to insolvency and debt hell.

I do realise that, when looking at this chart, you have to consider that some countries are in a much better position to service their debt than others in the same circle of debt hell. For example, I believe that most of Japan’s debt is held within Japanese financial institutions, is at very low interest rates and that Japan can easily service its debt whereas a hopeless typical African basket-case dump like Sudan is truly damned.

Another issue I noticed is that the UK has a much higher debt to GDP ratio than countries we tend to view as economic disasters like Argentina, Zimbabwe, Mexico, Egypt, Togo, Congo and others. Though, of course, again when comparing countries you have to take into account the level of interest they are paying and their ability to service their debt. So comparisons of countries in the same circle of debt hell are not quite as simple as the chart might suggest.

For copyright reasons, I cannot show the Visual Capitalist chart here. However, here’s the link to the chart. I hope you find it worth a look:

https://www.visualcapitalist.com/visualized-government-debt-around-the-world

There is an important point about this chart in relation to GDP. GDP includes government expenditure, which as far as I am concerned produces nothing that can help to pay down the debt. Government expenditure should be removed from GDP and then we will see the mess we are really in. The central banks need to be closed down and money printing stopped and the commercial banks need to end fractional reserve banking.

You also talk about the countries servicing the debt. They cannot service the debt without taking the money from us. As the WEF keeps telling us “you will have nothing and be happy”. It would be interesting to see what assets we have to pay down the debt. I suspect all our savings would vanish, if they even exist, and those with mortgages would have their property taken. Would this be enough?

Frank Chodorov saw our problem as always looking for the easiest way to achieve what we want. He used technology to show how we have done this in the past, and he also recognised that the result in wanting an easy life had resulted in socialism taking over in the USA from the early 20th century. This was apparent in a Channel 4 Q&A session held just before the voting yesterday. I saw a report that said the questions were either about what people could get “free” from the state, or who would pay for them. The article said we always blame the politicians for the problems but never see that we have a part to play in it. Socialism is our new god. Chodorov said – we can vote our way into slavery but we cannot vote our way out of it.

I saw a video this morning from the “Academy of Ideas” about stupidity based on book by Carlo Cipolla “The basic laws of human stupidity”. There are summaries on line and a free book but the print is poor. He defined a stupid person as someone who harms others without any gain for themselves. Miliband came to mind, but he has gained. He has a well paid job, a gold plated pension and power and authority to promote his socialist nonsense. It is the stupid we need to look out for and according to Cipolla they are everywhere. I think we are now realising that and there seems to be many more in the queue to replace the ones already in control.

Cipolla wrote his book in English and resisted an Italian version but it finally came out and was called “Fast, but not too fast”. This is described in a forward to the book and the writer wondered if that meant that we need to slow things down and I think that is becoming obvious. That will happen if the money we have only comes from production of goods and services and not the banking system.