We’re constantly being told that putting our money in shares through unit trusts or pensions or ETFs or OEICs or whatever, will make our savings grow in the long run. Article after article in the Money pages of our newspapers use projections of�5% or�6% a year to show how our savings will increase. But these articles never mention if the enticing�5% or 6% a year growth rates are before or after inflation.

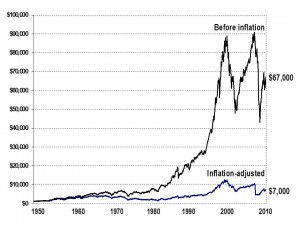

If you’d put $1,000 into US shares in 1950, you’d now be sitting on a wonderful $67,000. But knock out inflation and this becomes just $7,000. Bottom line – in 60 years your savings have hardly grown at all (see diagram below). The situation is similar for UK shares. And few of us save for 60 years.

Moreover, note that most of the market growth came in the 1980s and 1990s when babyboomers were at their earnings and savings peak. When babyboomers start retiring and buying annuities, their money will come out of shares and into government bonds�- shares will stagnate or fall. So don’t believe the “your money could grow by 6% a year” lies from the people who want to get hold of your cash.