The Government’s scheme to force people to save for their pensions started with ‘auto-enrolment’ in October 2012. Since then about six million workers have been put onto the scheme. So, how have things gone for them?

Well, these six million workers and their employers have contributed about �1,000,000,000 into their pensions. This is now giving pension companies and multi-millionaire fund managers more than �20,000,000 a year in both declared and hidden fees. This is a truly amazing transfer of wealth from six million people with generally low wages to a couple of thousand (or maybe just a few hundred) people with extremely generous salaries and massive personal pensions.

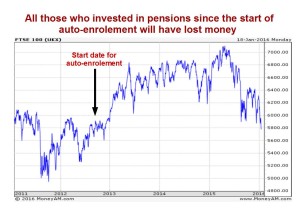

And what about the growth in these savers’ investments? Well, here’s the FTSE100 performance showing what happened since auto-enrolment pensions first started:

What you’ll see is that shares went up almost from the day auto-enrolment started. (I wonder if the rise in share prices was partially due to this extra money pouring into pension funds and thus the stock market?) In a way this rise is good as it meant that shares bought by the pension funds at the start of auto-enrolment went up in value. But it also meant that each time shares went up, the money being put into the market was buying ever fewer shares. Then the FTSE100 (and most other Western stock markets) reached a peak in the first part of 2015 and suddenly started a nosedive.

So, if we look at the �1,000,000,000 already invested under auto-enrolment:

- Probably about �40,000,000 has gone in fees and charges to pension companies and pension fund managers

- About �180,000,000 has been lost through collapsing share prices

This means that there’s only about �780,000,000 left in the pension pots of the workers who originally contributed �1,000,000,000. Around �220,000,000 seems to have ‘vanished’.

No wonder multi-millionaires like Karen Brady and Mr Sugar and others of their ilk were happy to appear in the Government’s “Are You In?” advertising campaign promoting workplace pensions. So far, workplace pensions have been an excellent way of taking money from the poor and giving it to the rich.

First there was QE giving ordinary savers virtually no interest; then the Government bailed out the banks with taxpayers’ money without placing any limitations on how much bankrupt bankers paid themselves in salaries and bonuses; then we saw huge increases in MPs’ salaries, pensions and expenses and now we have workplace pensions – all marvellous ways of taking from the poor to give to the rich. No wonder inequality in Britain is increasing so rapidly:

I have a theory: Every time there is a major war, a new breed of politicians and bureaucrats (who fought in the war) takes over and works to improve the sharing of national wealth because they genuinely believe in increasing social justice. For example, after WWI there were various pieces of legislation passed as part of making Britain “a country fit for heroes” and women were given the vote. After WWII, the NHS was founded.

Then as memories of the war fade, the politicians and bureaucrats with a conscience are replaced by career politicians and careerist, self-serving bureaucrats, most of whom have never had a proper job in their lives, and, because these politicians and administrators are in the pockets of City financiers and banks and other such power groups, the process of squeezing the middle and lower classes and transferring their money to the already wealthy begins again.

Roll on Bitcoin then.

The best way to undermine these people is to find another medium of exchange that is not controllable by government.

Bitcoin, or something like it, has the capacity to achieve this, which is why the governments of the world are so aggressive in this context… It has the capacity to get away from them once critical mass has been achieved.

I’ve had one of these infuriating things foisted upon me. I am not allowed to opt out other than by informing the company concerned every year. Whereupon there is an inexplicable administrative oversight and I end up paying into it anyway until the next statement appears informing me of this unprecedented error.