I understand that today’s post will not be relevant for most readers. But if you know anyone retiring within the next 10 years, maybe you could warn them about the annuity rip-off. And if you know anyone who has retired and bought an annuity within the last 10 years, they’ve probably been cheated and so you could help them complain and get thousands in compensation. So, please be patient and bear with me even though today’s subject be not be useful to you.

When we approach 65, unless we are one of the lucky few with a final-salary pension (less than 10% of private-sector workers and more than 95% of public-sector workers), the company holding our pension savings or our financial adviser will contact us suggesting that we use our pension savings to buy an annuity. The sales argument they will use will be something like “buying an annuity will give you the security of a fixed income for the rest of your life”. To back up their sales pitch, they’ll probably also claim that by buying an annuity, our pension savings will no longer be at risk if the stock market falls.

But buying an annuity at 65 is probably one of the worst financial decisions we could ever make. Here are a few reasons why:

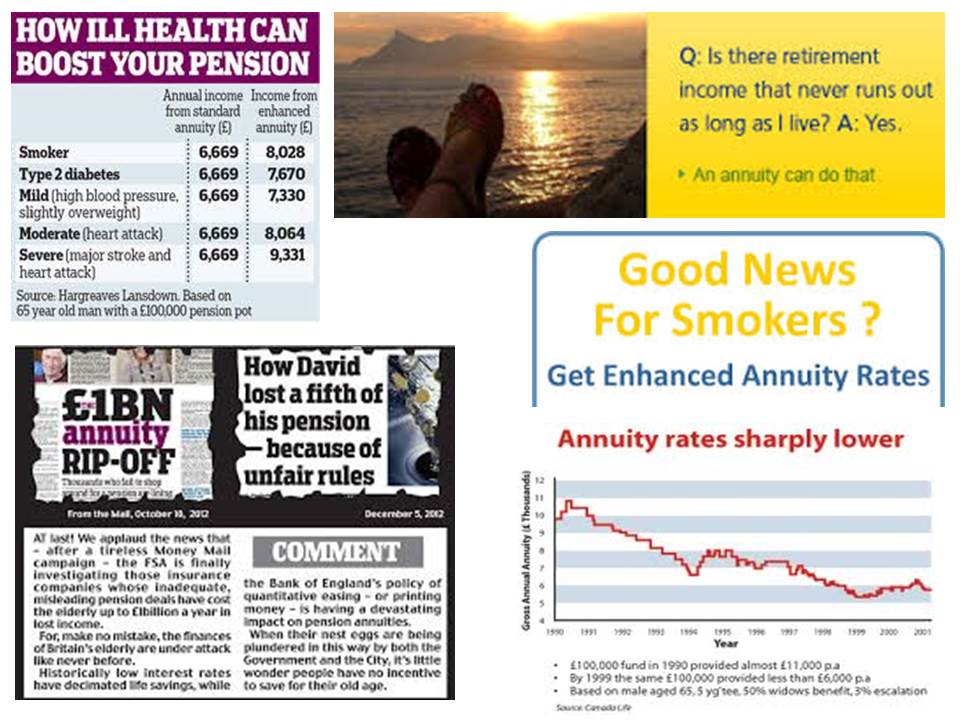

1. Laughably low annuity rates – If you want an inflation-protected annuity for yourself (and maybe a partner) you’ll get about 3.5% (£3,500 for every £100,000 in your pension fund). For that 3.5%, you’re handing over all your money to the annuity company. So, if you die, they keep your money. But, if you open a 5-year deposit account with someone like the Skipton (I don’t recommend this as interest rates will rise within the next few years), you’ll get just over 3% and your money will still belong to you. So, if something happens to you, your money will go to your survivors. With annuity rates so low, you’re probably better to take 25% of your pension savings tax-free to live off and delay buying an annuity as the longer you wait, the higher annuity rate you’ll get.

2. Enhanced annuities – people with any of almost 1,000 medical conditions (http://www.pensionchoices.com/public/post/enhanced-annuity-list-of-qualifying-medical-conditions-and-illnesses-186.asp) are eligible for an “enhanced annuity”. Because of their medical condition, the annuity company expects them to die younger than the average retiree and so will pay them a higher income while they are still alive. Of the 400,000 people who buy an annuity each year, it’s estimated that around 240,000 should qualify for an enhanced annuity. Yet only about 80,000 people actually get one. So 160,000 annuity buyers a year are being cheated out of sometimes thousands of pounds a year because those selling them their annuity failed to check whether they qualified for an enhanced annuity. This is making annuity companies billions of pounds a year in what can only be described as fraudulently-obtained profits.

3. You might get ill after 65 – even if you are one of the 40% who doesn’t qualify for an enhanced annuity when you’re 65, it’s unfortunately rather likely that you will develop some medical condition between the ages of 65 and 75 (the latest you can buy an annuity). If you’ve already bought an annuity at 65 and then develop a medical condition entitling you to an enhanced annuity, then tough. The annuity company has got your money and they couldn’t care if your health changes. In fact, the shorter you live. the better for them. But if you’ve ignored the “buy an annuity at 65 to get financial security” sales pitch and waited a few years, you’re much more likely to qualify for a larger enhanced annuity. It’s estimated that by 75, over 80% of retired people would qualify for an enhanced annuity. Yet, as I explained above, only 20% of people actually get one.

Annuities are hugely profitable (for the annuity companies) aggressively sold/mis-sold to financially-vulnerable people leaving many victims thousands of pounds a year poorer than they should have been. Don’t let yourself or anyone you know be scammed by the “buy an annuity at 65” sales pitch.