After yesterday’s brief visit to that earthly paradise – North Korea – I’m afraid it’s back to bankrupt Britain today.

When all the supposed “experts” are pontificating about chancellor Osborne’s economic policy (or lack of), they tend to lamely conclude that Osborne’s plan for reducing the deficit is having to be pushed back a few years. What they�usually don’t mention is the catastrophic effect this delay is having on our national debt – increasing at �3,800 per second, �228,000 per minute, �14m per hour, �329m per day, �10bn a month, �120bn per year. This rising debt means that our annual interest payments will shoot up from �30bn at the 2010 election to �43bn this year to �64bn by 2016 – an increase of �34bn a year from 2010 to 2016

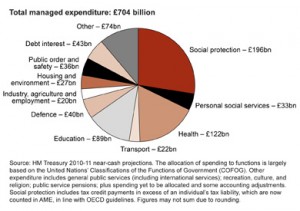

So, what can we cut to pay for this �34bn increase in our annual interest payments? Well, we could scrap the police. Whoops – that will only save about �19bn. But if we�also close all prisons and release the prisoners, that would take us up to �30bn�(see chart) So, just �4bn short of what we need to save.

Or we could get rid of all our armed forces – about �40bn – that would do it. Or halve spending on education? Or cut the NHS budget by a third? Or make a 20% reduction in all pensions and benefits payments?

The problem is that these drastic and politically-impossible cuts would only allow us to�keep up with�our increasing interest payments. They would do nothing to reduce the deficit. So our debts and interest payments would keep on going up.

I don’t know why, but few if any journalists and experts seem to understand the seriousness of our economic situation. We are caught in an ever-worsening spiral of more borrowing leads to higher interest payments lead to more borrowing leads to higher interest payments lead to more borrowing……….. At some point, we’re going to hit a very solid wall, when we can no longer borrow at affordable rates and the resultant financial crash is going to be very messy indeed.

Most people seem to think the financial crisis is over – it hasn’t even begun.

(Tomorrow, I’ll look at what taxes chancellor Ed Balls would have to raise to pay for Osborne’s Brownian borrowing binge)

Leave a Reply