Unless you’re a higher-rate taxpayer or get generous contributions from your employer, it’s probably not worth saving in a pension fund.�Some figures:

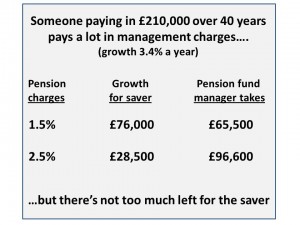

Like�unit trusts, the charges of just�1.5% to�2.5% that we pay to pension fund managers can look quite trivial. But over the longer term, they can have a disastrous effect on our retirement income and a correspondingly wonderful effect on the retirement income of our pension fund managers.

Take a�saver who�from 25 to 35�puts in �2,000 a year made up of own contributions, money from employer and tax relief. From�35 to�45 this goes up to �5,000 a year and from�45 to 65 to �7,000 a year. By 65, the saver�will have put a wonderful �210,000 into their pension fund.

Assuming the money grows by�the pension fund industry average of 3.4% a year. If the money is in a low-cost pension scheme with just 1.5% in fees, the saver will have �286,000 left. But the fund manager will have taken a healthy �65,500 for his or her efforts. If, as is more likely, the total charges including high 1st- and 2nd-year commissions, annual fees and dealing costs are actually around 2.5%, then the saver’s �210,000 will have only crept up by a very modest �28,500 to �238,500. But the fund manager won�t be too worried as they�ll pocket �96,600 (see figure)

In Denmark, Holland and Germany, management fees are 0.5% or less. But in Britain they’re�3 to�5 times as high. I believe the only way to save for a pension is�with a�low-cost SIPP (o.5% charges) and buy shares directly – do not, repeat not, put your SIPP money in a unit trust or other kind of fund otherwise you’ll be paying both your SIPP charges (0.5%) plus fund charges of say 2.5%. Only a madman or fool would do that – but sadly that’s precisely what most SIPP savers do.