In a desperate attempt to avoid national bankruptcy our work-experience, napkin-folding�chancellor is doing everything he can to keep interest rates artificially low – magicking �375bn from nowhere to buy government debt and the appalling Funding For Lending. These have devastated the rates of interest savers are getting to such an extent that there is not a single savings account available that beats inflation.

But this has been wonderful for City insiders as those with savings, desperate to get a real return, are being forced to put their money into risky, stock-market “investments” which pay huge commissions and fees to those who manage our money. About �60bn of savers’ money has gone into “structured products” sold by banks. These promise to pay say 80% of any rise in the stock market and guarantee your money back if the market falls. Unfortunately people putting money in these don’t seem to understand that�80% of the money you�make from�shares is�from the dividends, not from moves in the market. These products don’t pay any dividends.

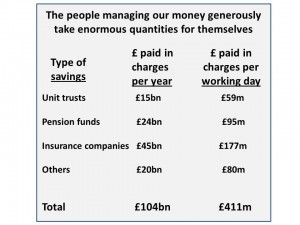

We have over �500bn in unit trusts. Over a five-year period 75% of unit trusts underperform the market yet their managers cream off a scarcely believable �15bn a year (�59m every working day) in charges, fees, commissions and dealing costs.

In total, we have around �350bn in the hands of people who extract all kinds of fees and charges and we are paying those who sold these to us and who are holding our money an incredible��104bn a year (�411m every working day). That’s why they have bigger houses, swankier cars, more luxurious holidays and a much better lifestyle than those whose money they manage (see diagram below)