As most people know, Greece is bankrupt. Its debts are now around 175% of GDP and can never be repaid, especially as GDP has collapsed by a quarter since the start of the 2008 recession. One in every four Greeks is now unemployed and half of all young (18-24 years old) Greeks are unemployed. Unless something changes, we have a massive human tragedy whereby hundreds of thousands of young Greeks will never get a proper job in their lives.

The new Greek Syriza government is asking for some kind of debt rescheduling and write-down so that it can try to kick-start economic growth and has suggested that Greek repayments be linked to economic growth. But Germany has flatly rejected any further concessions to Greece (which, of course, give yet another clear insight as to who really runs the EU as the opinions of all the other countries in the Eurozone seem to be irrelevant).

But by insisting that Greek debts be repaid – even though this is quite impossible – arrogant Germany seems to have forgotten recent history, when Germany’s debts were cut by around 62% and repayments were linked to economic growth – exactly the kind of deal Greece is asking for.

After WWII, the allies realised how damaging the reparations imposed on Germany at the Treaty of Versailles following WWI had been and so as part of the London Agreement of 1953 organised the debt forgiveness to give Germany the opportunity to rebuild its economy in the hope that it would never again start another European war.

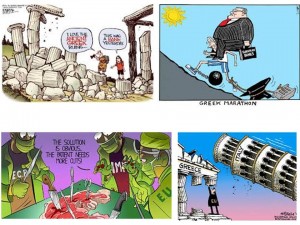

“More than 50 percent of Greek debt needs to be written off,”�said�a top Syriza economist. “The solution that was given to Germany at the London conference in 1953 is what we must do for Greece.��(click to see more clearly)

Much of the German debt that was written off consisted of loans taken to fund the Germans’ murder of about 30 million people in their WWII attempt at world domination. But now the Germans have decided that every country should live within its means and no country should be given the chance to escape from past mistakes in order to start to rebuild their economies. As they pile the economic pressure on tiny Greece, the Germans seem to have totally forgotten how they were bailed out just 62 years ago.

Behind all the current shenanigans is a possibly interesting moral question: If a bunch of thieves (mainly German and French banks) lend money to a bunch of profligate fools (the Greeks who were actually already bankrupt when they fiddled their figures to be accepted into the Eurozone) in the full knowledge that the fools would never repay the money and then the thieves could force politicians to use taxpayers’ money to reimburse them for the worthless loans they had made, who is most in the wrong and should foot the bill? The thieves who originally made the loans to the bankrupt fools? Or the bankrupt fools who spent all the money they could never repay?

That’s the question the self-righteous Merkel and the somewhat forgetful Germans seem unwilling to face.

But, as usual, those who get screwed will be ordinary EU taxpayers who never had a clue what their rulers were up to in their desperation to�force the Euro onto the continent in order to�create their dream of a single, borderless European superstate ruled by a corrupt, undemocratic, wasteful, self-serving, hereditary bureaucratic elite.

There will be many who disagree with me but from a german perspective (I am English) why should they write off Greek debt. The Germans work hard, invest in training, education, science, industry & engineering. They take pride in what they produce (like we used to) why should they bail out the equivalent of benefit claimants who have no intention of working?

A number of German companies such as Siemens bribed corrupt Greek Politicals into awarding them major constuction projects like the Athens subway system. Built by German company paid for with money loaned From German bank. Google up the video

DEBOCRACY with English subtitles.

If Greece returned to the Drachma it low exchange rate would enable the economy to recover,

It’s only a matter of time before Greece exits the Euro and when the remaining PIIS countries see how well they are doing the rest will leave one by one. The Germans will then be faced with having to trade using a much higher currency value. As they say what comes around and it couldn’t happen to a nicer bunch.