I have previously written about why we need to talk to our parents about their money. I imagine most readers thought either I was being excessively alarmist or else that as the people they knew over 60 were intelligent professionals, there’s no way they would allow themselves to be fleeced by financial services salespeople. If these were your reactions, you were wrong, very wrong.

Some facts:

Annuities – About 90% of annuities are mis-sold. This means annuitants are getting less money than they should every month for the rest of their lives. About 360,000 annuities are sold every year. So 324,000 a year (6,230 a week, 1,246 every working day) are mis-sold.

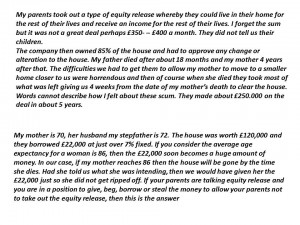

Equity Release – Equity Release is a fairly new product. When many people had final-salary pensions, there was little need for Equity Release. But as final-salary pensions have vanished and people are finding out how little there is in their retirement funds (due to high charges and poor investment performance) and how low annuity rates are, many are turning in desperation to Equity Release. We don’t know how widespread mis-selling is. But there’s no reason why it should be any less than with annuities (click on image to see clearly).

Dud investments – I wrote yesterday about how �60bn of savers’ money (usually older savers) has gone into worthless structured products sold by banks and another �75bn has gone into expensive unit trusts, 90% of which fail to even match overall stock-market performance due to their high charges.

There seem to be 3 main reasons why older savers are being constantly fleeced

1. They are part of Generation Trust – they come from a generation when you could trust you bank manager or pension adviser or financial adviser to look after your interests. So they fail to understand the levels of greed, dishonesty and corruption that are now rife in the sale of financial services

2. They’re too proud to admit problems – many older people are not used to talking to their children about their financial situation and are too proud to admit they are struggling. These makes them easy prey for people selling usurious equity release or dud investments

3. They’re vulnerable – Most of the country’s savings are owned by people approaching or already in retirement. Financial services insiders call them the “banana skin and grave brigade” because they have one foot on a financial banana skin (they know little to nothing about savings and investments) and one in the grave (so there’s no harm relieving them of their money before they go). Older people living increasingly isolated lives or on their own are particularly at risk as they’ll tend to be more accepting of a commission-based financial salesperson visiting them in their homes to flog them some supposedly ‘safe’ financial product. And people in retirement homes are also at risk as many retirement home managers have struck dirty little deals with financial sellers whereby they can come into the homes to sell their stuff and the manager(ess) gets a taxfree, cash in an envelope kickback from the seller.

The older generation are getting fleeced by the financial services industry. Don’t believe that just because someone had a successful active career that they’re immune. They’re not. In fact, they’re prime targets as they have confidence in their own judgement and so are more easily fooled.

You need to sit down with everyone you know who is over 60 and ask them “who is after your money?”. You have to find out which organisations – banks, investment companies (St James Place, Fisher Investments etc), equity release companies,�boiler-room share sallers�or whoever – have been soliciting them to get hold of their money. Then you have to explain why most of the stuff they are being sold is financial garbage designed to make the seller a lot richer than the buyer.

This is a difficult conversation to have. But if you do have it, you could save them from being thoroughly fleeced by today’s totally amoral financial services industry.

(Tomorrow – explosive stuff. A secret tape recording of two people called Wendy and Tony in the bedroom of a house owned by someone called Rupert. Don’t miss it!)

Any non smoker taking out an annuity should claim to be a smoker and get themselves a better rate. Not honest, but nor are the insurance companies.

nice articles