Wednesday/Thursday blog

Running off a cliff

The world’s economy could seem a bit like a cartoon character who runs off the end of a cliff. As long as they don’t look down, they can keep on running:

But as soon as they look down, they say something like “oh-oh” and this happens:

Borrowing keeps the world going round

Here’s an infographic from the excellent “The Visual Capitalist” website showing the debt to GDP levels of most indebted of the world’s countries:

(left-click on chart, then left-click again to see more clearly)

Following the Chinese lab-leaked plague pandemic, world debt levels rose at the fastest rate since WWII and keep on going higher.

The World Bank has estimated that around 97 million people have been pushed into extreme poverty due to the pandemic. In order to help alleviate the economic destruction caused by Xi Pingpong’s Chinese Communist Party lab-leaked plague, global governments have had to increase their expenditures to deal with higher healthcare costs, unemployment, food insecurity, and to help businesses to survive.

How everyone owes money to everyone else and nobody can pay

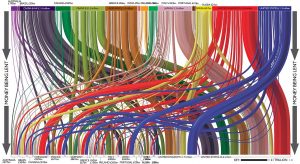

Here’s a chart readers may find confusing. It’s a bit dated (it’s from 2012). But it shows which countries are the main lenders (the countries along the top line of the chart) and which countries are the main borrowers (the countries on the lower line of the chart):

(left-click on chart, then left-click again to see more clearly)

The thickness of the lines shows the amounts of money being loaned.

First thing you might notice is that some of the countries doing the most lending are also doing the most borrowing. Confused? You should be.

Basically, banks and governments are all holding mountains of each others’ debts while governments keep lending and borrowing more. No, I don’t understand it either.

But this thing makes a house of cards look solid. As soon as one country defaults, the whole thing is going to collapse.

The Greece bailout farce

This almost happened when the EU (European Central Bank� ECB) and IMF and others of their ilk supposedly bailed Greece out after the 2007/2008 financial crisis. We were told that our money was being used to help Greece. In fact, I believe that most of the money went to banks in Germany, France and Italy which had lent the long since obviously bankrupt Greece probably more than �130bn of Greece’s total of the �323bn debt.

We were actually bailing out the Western European banks which had made massive loans which they knew Greece could never repay as they were confident that, when things inevitably went pear-shaped, governments and international financial institutions would use taxpayers’ money to bail out the banks. And the bankers would still get their bonuses.

How does it all end?

Fortunately, Greece was a fairly minor economy and its default didn’t cause the whole system to implode. If somewhere like bankrupt Italy or bankrupt Spain defaults, then things will get more interesting.

Will someone look down and a massive world financial crash follow? Who knows?

Luckily for our lying politicians, most voters don’t know the difference between “deficits” and “debts”. So, when a government announces it will decrease a country’s deficit, many voters think this means debts will also go down. However, most readers here will understand that as long as a country runs a deficit, its debt will increase. And I can’t see any Western government (apart, of course, from Germany) ever running a surplus and beginning to pay down its debts.

Most advanced economies are running deficits. Therefore most are increasing their debt levels.

And a thing can only continue until it stops.

REVELATION 13:17 NO ONE CAN BUY OR SELL

I have just been reading about Japan and it is at the centre of the wheel. Japan was booming at one point and then it started to tax and borrow. Taxing a successful economy to spend on unproductive projects is the way to failure, as we know here.

It’s only numbers on computers – just wait for the EMP burst above the USA (when China grabs Taiwan) and all the information will be lost.

Russia’s National debt currently stands at a disgraceful $280 billion. As opposed to a much more praiseworthy �2,223 billion for the UK and $3 trillion for the USA.

No wonder our government of Third-World banksters hates Russia.

Reality closing in fast,even Boris having doubts about net zero? Everything is about the collapse of the USA reserve currency and their blatant financial corruption since WW2.They are no friends of ours and we should cut ourselves loose from them and the EU.Full scale drive for self sufficiency in all things.Dig coal,300 years of reserves down there,get franking.Start manufacturing things we really need.Our climate enables us to be potentially self sufficient in food if survival is the key.Forget exotics,a return to seasonality and sustainability.Not likely to happen though,unless total financial collapse does occur.

I cannot think of one thing that has come ot of the USA in the past 80 years that has benefitted or improved life in this country,quite the opposite in fact.

To the Palmer comment, think you�re mixing up deficit and debt. The USA national debt is now approaching $30 trillion. This was once thought to be unsustainable, but they just keep printing billions of new dollars and seemingly are getting away with it. Have we discovered the �goldilocks� economy? Just print money when needed? Or should we be looking at a Weimar German 1923 situation? Maybe the Ukraine, Russian conflict will be the catalyst, it�ll certainly affect food prices. Whatever, I�ve stocked up on gold coin (and some silver) – comes into its own when paper money becomes worthless.

Saw a good comment in the Telegraph about fracking in the UK, disgracefully banned by our idiot government in 2019

�Both Lancashire gas exploration wells flowed very high-quality natural gas to surface from just a handful of fractures completed in the underlying shale rock. The limited number of fractures completed was due to the regulatory requirement to halt operations any time micro-seismicity induced by fracturing exceeded just 0.5 on the Richter scale. Liverpool University equated the impact of 0.5 micro-seismic event to sitting down on an office chair.

Claims that less than 1\100th of the huge in place gas resource of 37.6 trillion m3 could be extracted – report referenced has no actual UK data on gas recovery & uses pre-2010 US data, before hydraulic fracturing techniques were advanced to improve gas recoveries to as high as 30% of in-place volumes. Just 10% gas recovery from Bowland shale could supply 50 years� worth of current UK gas demand.

To produce the same amount of energy as one 4 hectare shale site

Both Lancashire gas exploration wells flowed very high-quality natural gas to surface from just a handful of fractures completed in the underlying shale rock. The limited number of fractures completed was due to the regulatory requirement to halt operations any time micro-seismicity induced by fracturing exceeded just 0.5 on the Richter scale. Liverpool University equated the impact of 0.5 micro-seismic event to sitting down on an office chair.

Claims that less than 1\100th of the huge in place gas resource of 37.6 trillion m3 could be extracted – report referenced has no actual UK data on gas recovery & uses pre-2010 US data, before hydraulic fracturing techniques were advanced to improve gas recoveries to as high as 30% of in-place volumes. Just 10% gas recovery from Bowland shale could supply 50 years� worth of current UK gas demand.

To produce the same amount of energy as one 4 hectare shale site

case for shale gas is strong & logical. HMG needs to lift the moratorium urgently.�

Gary Halstead

Cocked that up- this is the comment:

Both Lancashire gas exploration wells flowed very high-quality natural gas to surface from just a handful of fractures completed in the underlying shale rock. The limited number of fractures completed was due to the regulatory requirement to halt operations any time micro-seismicity induced by fracturing exceeded just 0.5 on the Richter scale. Liverpool University equated the impact of 0.5 micro-seismic event to sitting down on an office chair.

Claims that less than 1\100th of the huge in place gas resource of 37.6 trillion m3 could be extracted – report referenced has no actual UK data on gas recovery & uses pre-2010 US data, before hydraulic fracturing techniques were advanced to improve gas recoveries to as high as 30% of in-place volumes. Just 10% gas recovery from Bowland shale could supply 50 years� worth of current UK gas demand.

To produce the same amount of energy as one 4 hectare shale site of 40 wells would require a wind farm some 1500 times that size or a solar park nearly 1000 times the size. At current UK gas prices, the value of just 10% of the in-place UK gas would be approx �3.3 trillion. Potential tax take from this could be close to �200 billion. Imported gas produces no tax, no jobs & higher CO2 emissions. Gas prices can of course go down but we don’t share doubts that UK could ever be commercially viable. Gas from the existing Cuadrilla wells could & should be flowing to local domestic consumers within a year of equipment re-mobilising to site. 6 other such sites located across Northern England could be producing gas & making a material contribution to energy security & tax revenue within 4\5years. The case for shale gas is strong & logical. HMG needs to lift the moratorium urgently.

Gary Halstead

Test fracking was vehemently opposed by green zealots who appear to be so thick as to conflate a tremor with an earthquake. I saw one scruffy wierdo on GB News saying “they” would use the explored drill-holes of any fracking as storage pods for nuclear waste! Why would any government with a happorth of common sense listen to such dreamers who, presumably would be happy to wear wode and animal fur rather than join the rest of us in 2022.

David Fabb