One underlying theme of my books like�SQUANDERED,�FLEECED, PILLAGED and GREED UNLIMITED is that, whatever our governments (of whichever party) say, what we’ve actually had in Britain over the last 30 years has been a massive redistribution of wealth away from from those on lower and middle-range earnings and into the bank accounts of the well-off and the seriously wealthy:

Perhaps this is most apparent in housing:

House prices have shot up much faster than wages (click to see more clearly):

In 1985, the average house price was around 3.5 times the average wage, now it’s around 10 times the average wage. But then what else would you expect when successive governments have allowed 46,000 people a month to flood into Benefits Britain for the last 15 years?

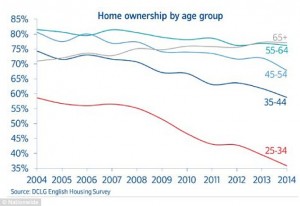

The house-price rise has resulted in a massive drop in the percentage of younger people owning a home, while the percentage of older homeowners has remained fairly stable:

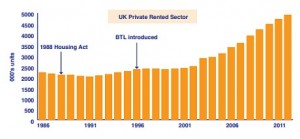

While rising prices may have kept the young out of the market, they have, of course, led to huge growth in the buy-to-let market:

The rush into owning buy-to-let properties has put further upward pressure on house prices making it more difficult for the young to buy, thus�giving more to those who have and making the chance of owning a home ever more remote for those who have not.

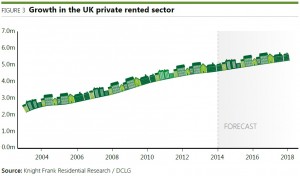

In just the last 10 years, the number of buy-to-let properties has almost doubled from just over 2 million to over 4 million:

Many of the people purchasing buy-to-let properties are doing so in desperation as their savings get little to no interest and their pensions are being looted by pension fund managers. But that rise of over 2 million buy-to-let properties means about 2 million younger people are renting now whereas just 10 years ago they could have been owners.

Some buy-to-letter have made fortunes, others are probably just keeping their heads above water. But now many older parents find they are having to use their savings, cash in their pensions, downsize or take out usurious equity release loans to get their offspring into the home ownership game.

But all may not be sun, light, money and laughter for the happy buy-to-letters. Tax changes tend to follow social changes. A big social change has been the rapid growth of buy-to-let. While owner-occupiers no longer get tax relief on their interest payments, the Treasury would be able to squeeze another �14bn a year out of us if it removed tax relief on buy-to-let mortgages.

I wonder how much longer our cash-strapped, financially-incontinent, overspending Chancellor will allow that lovely �14bn to slip through his fingers?

If I was a buy-to-let landlord (which sadly I’m not) I’d be looking at what would happen to my profitable little buy-to-let empire if I (and all the other landlords like me) suddenly found our mortgage tax relief were to disappear.

Most BTL landlords are not wealthy and just own one or two rental properties in a response to continual Government raids on pensions and savings.

While undoubtedly BTL has been responsible for part of the uplift in house prices, particularly in University towns, the biggest factor by far has been the massive increase in credit and rash lending by banks during the Brown “boom”.

A property is only viable to a landlord if he can cover his costs with the rent – only low interest rates make this true for the more exposed. Furthermore banks (even in the crazy credit boom) require the rental income to be 120%+ of the interest payment. And rents are largely determined by tenant income in that area.

A lot of the flats rushed up by developers (eg in Leeds/Manchester/Liverpool) in the “boom” were specially targeted at na�ve southern BTLers – these would not have been built in the first place without that wall of BTL money as an attractant.

“tax relief on buy-to-let mortgages now costs the Treasury around �14bn a year.” It doesn’t cost the Treasury anything – they are just grabbing less money than they might do. The Private Rental Sector (PRS) has largely replaced social housing so if they do remove this relief then after a sugar rush where the richer tenants buy a cheap offloaded BTL there will be a lot of homeless as the PRS falls off a cliff.

Looking at his from another angle; I don’t think we have a housing shortage, I think we have a population excess.

You are both right. I have amended today’s blog accordingly.

Great post.

The only point I take slight issue with is that about increasing income inequality. It’s not always a bad thing! If you have a very enterprising country with entrepreneurs making money hand over fist that’s a good thing even if it leads to income inequality, because they are generally creating jobs and wealth at the same time.

In the case of Britain the initial upswing in inequality coincided with a much more dynamic economy under Thatcher and so could be justified. What we’ve had since New Labour and now under Cameron though is the best example you could find of bad income inequality. The biggest cause under the coalition was QE which doubled rich people’s wealth while not reflecting any real growth in the productivity of the economy.

Great site.

How about the decent, respectable owner occupiers who have to live next door to a BTL property occupied by criminal scum? This is precisely what has happened in the erstwhile peaceful close of 24 bungalows where I live. Sadly for me, the tenants are in the bungalow to which I am semi-detached. They kicked off by breaking into my car and stealing my petty-cash, have vandalised the back garden and cluttered the front with junk which everyone can see, and curse and swear from dawn ’til dusk. The Police, who know the family, do their best but their powers are limited. The Local Authority don’t care – anything as long as they don’t have the responsibility for housing such people. The owner, a money-grasping middle-aged female, lives in locally, in a very quiet street, but refuses to take any action, quite blatantly stating that as long as she gets her rent (paid by Housing Benefit) she doesn’t care. The capital value of the property will inevitably rise long-term, irrespective of its deteriorating condition. So I’ve no sympathy either for landlords or for many tenants. Much better in the “bad old days” to ghetto certain low life into designated portions of Council estates.

I fully understand and sympathise with you keen reader as the house next door to us was rented out for a while and it wasn’t good. As for the tax relief being stopped in interest payments for BTL, all that will happen is it will be passed on the the hapless tenants (they aren’t all bad). My daughter has to rent private as the local authority have pooed on her from a great height after 5 years of fighting for a suitable local authority property. (she is disabled)

Now the government is openly attacking buy to let based on BoE recommendations, what happens to the tenant and property market, will smaller so called accidental landlords be forced to sell? Or will the increased cost be passed to tenants creating even more difficulty and potential social fallout?

https://www.commercialtrust.co.uk/news/property-law/section-24-judgement/