I’ll try to keep this simple today in case some useless, overpaid, overpensioned politicians are reading it. Though I doubt any are. They’ll be too busy cheating on their expenses and finding second, third and fourth jobs to fill in all the free time they have and fill up their bank accounts.

Imagine I have to fill out some official document and it takes a civil servant an hour to check what I’ve written and input it into some computer system. Let’s call that ‘one transaction’. What will that�transaction�cost the taxpayer? Probably about �50 in administrative time (including the civil servant’s salary, pension, office costs, manager’s time etc etc).

Imagine a million people fill in the same form. Ooops, those million transactions will cost the taxpayer �50m in administration. Now let’s imagine the Government makes the system more complicated with more rules and the document becomes twice as long and more complicated. So we’re up over �100m.

With me so far? The more transactions that are generated and the more complicated those transactions are, the more the administrative cost will rise.

Now let’s take one of the stupidest policies ever devised by a politician – Gordon Brown’s ‘in-work tax credits’. These were designed to help people on low earnings.

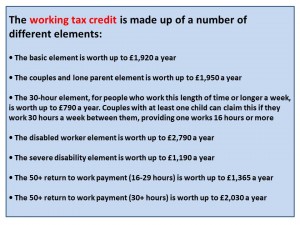

Here’s a brief outline of in-work tax credits:

So, the basic working tax credit is worth just over �40 a week – say �1.20 an hour.

Just taking a guess, I’ll assume it takes about 5 hours a year to calculate and administer each tax credit claimant’s situation – �250 in administration.

The total number of people claiming ‘in-work tax credits’ is around 3,300,000. So, it’s possibly costing �825m a year to administer.

Wouldn’t it be much simpler to abolish in-work tax credits completely and just increase the minimum wage by �1.20 an hour while scrapping NI on anyone earning less than say �8/hour? That gives you massive simplification, cuts administrative costs by �825m and doesn’t increase employers’ costs by much as, even though they would pay an extra �1.20 per hour, they would no longer have to pay NI on the low-paid.

The problem with in-work tax credits is that, like everything developed by politicians who have never had a proper job in their lives, they fail to understand that something which looks simple on paper for just one person, suddenly becomes a costly nightmare when it has to be administered for millions.

When I worked as a consultant, one of the acronyms we used was USA – Understand, Simplify, Automate. Understand how a process works; Simplify it as most processes become more complex over time as people meddle with them; then Automate it to make it cheap to run.

Sadly our politicians, having never worked in their lives, don’t understand how the number of transactions and their complexity just lead to ever more administrative cost.

The latest example of this stupidity can be seen in Osborne’s plans for inheritance tax (IHT). Osborne claims he wants families to keep more of their wealth. So, the easiest thing would be to increase the IHT threshold from the current �365,000 to say �500,000. But no, instead Osbum has come up with some complex idea of each parent being given as extra �175,000 tax exemption on the value of the family home or something like that. As usual with politicians, more complexity, more confusion, more administrative cost.

Please could someone tell our useless, clueless, never-had-a-proper-job-in-their-lives politicians that they must USA – Understand: Simplify: Automate – otherwise they can never cut public spending as they continually increase administrative costs.

It seems to me that politicians understand the USA principle very well:

1. Understand that directorships/side-jobs are incredibly lucrative

2. Simplify the recruitment process by making your own rules and laws that need to be administered by a certain friendly company/lobby group.

3. Automatically move onto board of said company/quango and clean up.

Nice one! Especially so early in the morning.

Try this for size. small business using sage payroll.

Last government decides to split the level at which NI starts for employees (primary) and employers (secondary) requiring new software upgrade �375. The difference between the figures was �60 per year x 13.8% NI =�8.28. We have 10 employees, so spent �375 to collect an extra �82.80.

Last year the government unified the two rates (how it used to be for many years), sage duly removed the spare field, requiring another upgrade. So rinse and repeat above calculation ( but with no extra NO collected)

This year.. yes, you’ve guessed it. Our government reintroduced the differential so is now �8060 primary (employee), �8112 secondary (employer).. again requiring new software to bring back the ‘feature’ sage removed last year.

Cost of software over 3 years �1125 to collect an extra �165.

Government realised their meddling costs, so rather than simplify the above, they instead introduced a �2000p.a. employers allowance to be deducted from the employers national insurance to be paid over.

Whilst the money is welcome from the employers standpoint, a substantial beneficiary of this government largesse is Sage Software. Take a look at their share price and you will see what I mean. Up 69% in 1 year.

PS: Employers with fewer than 10 employees can use the free software provided by HMRC.

Milton Friedman’s famous table springs to mind. When the money you are spending is (a) not yours and it is (b) being spent on someone else…well who cares?

bRuin didn’t give a damn about the cost effectiveness of Tax Credits – it was all about making people dependent on Labour and therefore voting fodder. Cameron (admittedly hampered by the LibDems) did not have the conviction or spine to scrap Tax Credits and tell employers to ante up the party’s over. 2 weeks after the election and still he hasn’t scrapped them – what can this mean?