Amidst all the bickering between the liars and fools in LibLabCon about whether the deficit is going up or down, our rulers are careful to avoid focusing too much on our debt. Our debt, of course, increases as long as there is a deficit. Perhaps the number we should be worrying about is debt, not deficit?

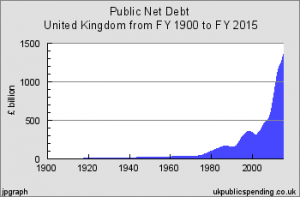

Our debt has more than doubled under the useless Coalition from about �700bn to �1.5trn. This doesn’t look terribly good for Britain. Moreover, we’re now paying around �1bn a week in interest on our �1.5trn debt. You could fund an awful lot of schools, hospitals and some wonderful pensions if we didn’t have to pay this �1bn a week in interest.

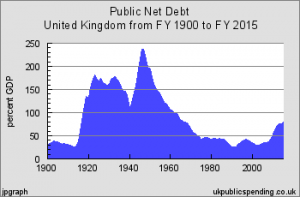

So, should we panic? That’s not certain. If we look at debt as a percentage of GDP, then the picture doesn’t look so worrying:

Although by 2017, our debt will probably reach 100% of GDP and that’s not so great.

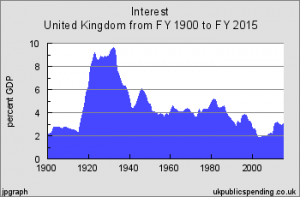

And if we look at our level of interest payments compared to GDP, again the picture doesn’t look too disastrous:

Our interest payments are ‘only’ just over 3% of GDP, which is not high by historical standards.

So, can we all relax? Difficult question.

What’s clear is that once a government gives a benefit or service, it’s almost impossible to take it away because of the howls of protest from the mainstream media always eager to find a victim of ‘vicious government cuts’.

It’s also clear that with unlimited immigration and the Eurozone in meltdown needing ever more of our money, public spending will continue to rise and will never fall.

Moreover, with 54% of the population getting more in services and benefits than they pay in tax, we’ll never get a government with the political will to control spending.

It’s easy to make alarmist predictions about lenders refusing us any more credit, impending bankruptcy and a collapse of the pound. But the most probable scenario is that we just muddle along as the ruling elites pretend to govern while just filling their pockets with as much of our money as they can and as our country is increasingly concreted over to make way for the immigrant hordes who will eventually outnumber us and turn our country into a crowded, squalid Third World hell-hole like the countries they’ve come from.

So, probably no panic. Just gradual and depressingly irreversible decline.

And, if you have children – tell them to borrow as much as they can, have a wonderful time at uni and then emigrate to Canada, Australia or New Zealand on graduation leaving their debts and the lousy British weather behind them. That’s what I would do if I had my time again.

“…our country is increasingly concreted over to make way for the immigrant hordes…”

I can only guess at the nightmare world you inhabit, but here are some facts of which you are obviously in ignorance:

Far from being “concreted over,” only 10% of England is built upon, and golf courses take up nearly double the land used for housing. Official figures from the UK’s National Ecosystem Assessment indicate that around 10% of England’s land is classified as urban, with most of it taken up by gardens, parks, roads and lakes. Just 2.27% of that is built upon and only 1.1% of it is used for homes.

Compare that to England’s golf courses which take up 270,000 hectares, roughly equating to 2% of England’s 13.4 million hectares in land area. There are over 2,000 full 18-hole golf courses, along with hundreds of smaller 9-hole and pitch-and-putt courses, which reach the combined total. English golf courses use an amount of land that is equivalent to one fifth of England�s total built up area and could provide at least eight million homes.

Professor Paul Cheshire, of the London School of Economics, said only radical changes would do. Promises to save greenbelt land, he said, were a mere �stalling tactic to appease the Home County set.� He said: �The Government will do nothing before next year�s general election but only radical changes, which will be very difficult to swallow politically, will solve the problem. This is a long-term crisis. It is not about now, or a price bubble. The reality is that we have had a shortage of housing supply for more than 20 years which has led to a shortfall of between 1.6 million and 2.3 million homes, and there is a huge, pent-up demand.�

Poor planning regulations have seen land prices increase 15-fold since 1955 – three times faster than house prices.

…and “immigrant hordes”? You mean like our German royal family and the Normans, the Saxons, the Irish, the Scots who number in the millions?

Shasha England has more people per square mile than most places in the world. If we had no population increase due to mass immmigration it would still be folly to activialy set out to increase our population. We are not self sufficent in food.

So you think its a good thing that the English people already a minoriaty in major towns and cities are set to become so in England. A few decades from now Japan will still be Japan, Except as a geographic entity England will not be so.

Why do you want to see England destroyed?

GDP is perhaps the biggest lie of the many, many lies politicians spew forth daily.

Just to pick one single example relevant to your post GDP is calculated as Y = C + I + G + (X-M). The G is of course government spending, currently funded by a huge deficit.

So if the government borrows to spend, then the GDP increases due to government spending, which they then compare to the amount they have borrowed to show there’s nothing to worry about!

At first glance, debt doesn’t look too bad in historic terms. But there are some very important differences to consider.

After the war private debt was close to zero, government was much smaller, the banking system was not bankrupt, there were undeveloped markets around the world to exploit and there were huge benefits to be had from developments such as semiconductors, computers, energy and mass transportation. There was other low hanging fruit to be had from advances in education and healthcare which were easy pickings.

We now have unaffordable pension liabilities, the NHS has become the International Health Service and Welfare only ever rises, exacerbated by the three main parties’ Immigration-2-Infinity policies.

Of course it may be that nuclear fusion will save us all but I fear that diminishing returns will mean that there is not much more of this to look forward to.

It may be true that in absolute terms only a relatively small proportion of our green and pleasant land is currently concreted over. However, every new estate or town that is built not only consumes the land on which it is constructed, but also pollutes with road development and its attendant noise, carbon emissions and potential for criminal activity, (since the new roads provide a quick getaway), a disproportionate quantity of surrounding land. Build a new development and people will, quite understandably inhabit it – but they will continue to work where they worked before, commuting dozens, sometimes even one hundred or more, miles to work each day. It is unsustainable in the long term.

Bear in mind that few people comprehend the difference between the annual budget deficit and the UK’s long-term debt. It is, as you rightly state, the latter about which we should be primarily concerned and the latter which the Government is doing nothing to address.

As for those UK graduates who are genuinely studying hard for a degree in something that will actually be of some use to the world and enable them to earn a decent living; yes, upon graduation they should head for the nearest airport, leaving their debts and a terminally sick, once great, Britain, to the tender mercies of the practitioners of the Religion of Peace.

It has to be acknowledged, however, that many immigrants, particularly those from Eastern Europe, work extremely hard here, harder than many of the native born population, who have become accustomed to being eligible for benefits upon the slightest of justifications. The fact that employers can recruit immigrant labour at rock-bottom wages, knowing that the benefits system will make up any deficit with tax credits, has however been a disaster. Any government which truly meant business would refuse benefits absolutely to any able-bodied UK citizen who refused work on the grounds of its nature or perceived status, thus overnight pushing thousands into genuinely seeking work, while at the same time withdrawing any and all assistance from inadequately paid immigrants, thus suggesting that they return to their countries of origin. Those moves alone would cut a hefty lump off the benefits bill. Of course, an additional factor has been the explosion in buy-to-let investments by tens of thousands of people who see buying and then letting a property as a preferable means of pension investment to letting the corrupt and double-dealing Life Assurance companies, such as Equitable Life, get their hands on it. Unfortunately, the ease with which tenants can obtain housing benefit has pushed rents to ridiculous levels, meaning that the government (i.e. we taxpayers) are picking up the tab. No factor in the total immigrant/housing/population/benefits/ national debt problem can be viewed in isolation. No government, unfortunately, has the guts to confront the whole picture and deal with it effectively, since no government looks further ahead than the next election, any more than the majority of its members think of anything other than their own personal financial advancement.