The FTSE100 Index was launched in January 1984 at a base level of 1,000. It replaced the previous main measure of UK shares – the FTSE30. You may not hold shares directly, you may not even have any of your savings in things like unit trusts, investment trusts or ETFs (Exchange Traded Funds). But if you’re saving for a pension (and don’t inhabit the pension paradise of having a final-salary pension) then a large part of your money will be in FTSE100 shares. So,�how well the FTSE100 performs�matters to most people.

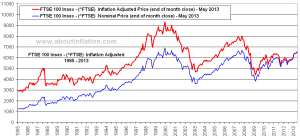

How well has the FTSE100 done? Well this graph tells you everything you need to know, doesn’t it? (click on chart to see more clearly)

There were two gut-wrenching, bowel-bursting collapses – in 2000 and 2008. But still, over its 30-year life, the FTSE has gone from 1,000 to over 6,600. So any money in shares in 1984 would have increased by a factor of 6 times. Yippeee! We’re all rich and will have financially secure retirements. What? We’re not all rich? How can that be?

The answer, of course, is inflation. The daily number giving the level of the FTSE100 (and all other stock�indices like the FTSE250, the Dow Jones, the CAC) is a nominal value – it’s not adjusted for inflation.

Here’s how the FTSE100 looks when adjusted for inflation. The blue line is the nominal value, the red line is adjusted for inflation.

It still doesn’t look too bad. Though the real purchasing power of money in shares would have doubled over the 30 years and sadly not gone up by a factor of six.

But let’s look more closely. One investment specialist, Fidelity (who make their money from encouraging us to invest in shares and unit trusts) described the situation ever so elegantly, “Over its 30 year life, the performance of the FTSE 100 Index can be split into two very different periods with strong gains over the first 17 years not destined to be repeated in the 13 years that were to follow.” I love the words “not destined to be repeated in the 13 years that were to follow”.�In fact, the real value of the FTSE has plummeted in the last 13 years. (Oddly, over the same period, despite their shares losing about 30% of the real value, the total remuneration of FTSE100 executives has shot up from an average of about �1,000,000 a year to about �4,000,000 a year.)

The good folk at Fidelity also wrote “the past year has seen the FTSE 100 Index move tantalisingly close to its record high of 14 years ago.” While this is literally true, it’s also highly misleading as inflation has reduced the purchasing power of our money by over 30% during the last 14 years. So the FTSE100 would actually have to hit about 9000 (and that’s not going to happen) to really reach the level it was at in purchasing power 14 years ago.

The baby-boomer effect?

What I believe is happening is something no investment specialist, financial adviser or financial journalist would ever mention. If they mentioned it, they’d be out of a job. Fast! Because nobody would want to invest in shares any more.

What I think happened was that from 1984 till 2000 the baby-boomers (those born between 1945 and 1965) were at their maximum earnings and saving potential and were shoving money into shares either directly or through unit trusts and pensions. But as the baby-boomers move towards retirement, they start selling their shares to generate money to live off and as they buy annuities, their pension savings get taken out of shares and put into bonds. And the next generation, Generation Debt, burdened with massive mortgages due to ludicrously high house prices� and student loans to be repaid, won’t be able to save as much as their parents. So, demand for shares is falling and their value will also fall for many years to come.

The US Government Accounting Office did a study estimating how much of baby-boomers’ money would be withdrawn from shares over the next 10 to 20 years and concluded that there was no need for investors to panic. A government department telling you not to panic is a bit like the captain of the Costa Concordia telling you to enjoy your dinner while he grabs his East European mistress and heads for the nearest lifeboat.

Leave a Reply