Whose pension is it anyway?

The Government is virtually bankrupt. Even under supposed ‘austerity’, the useless Coalition is spending �120bn a year more than it takes in taxes. We already owe over �1.2trn and this will rise to �1.4trn by the 2015 election. We can never pay this money back. So, if you’re relying on the Government paying you a reasonable pension in return for all the NI you’ve paid – forget it. Anyway, the Government will need at least �30bn a year more next year to pay for the flood of almost 2 million Romanians and Bulgarians heading for Benefits Britain.

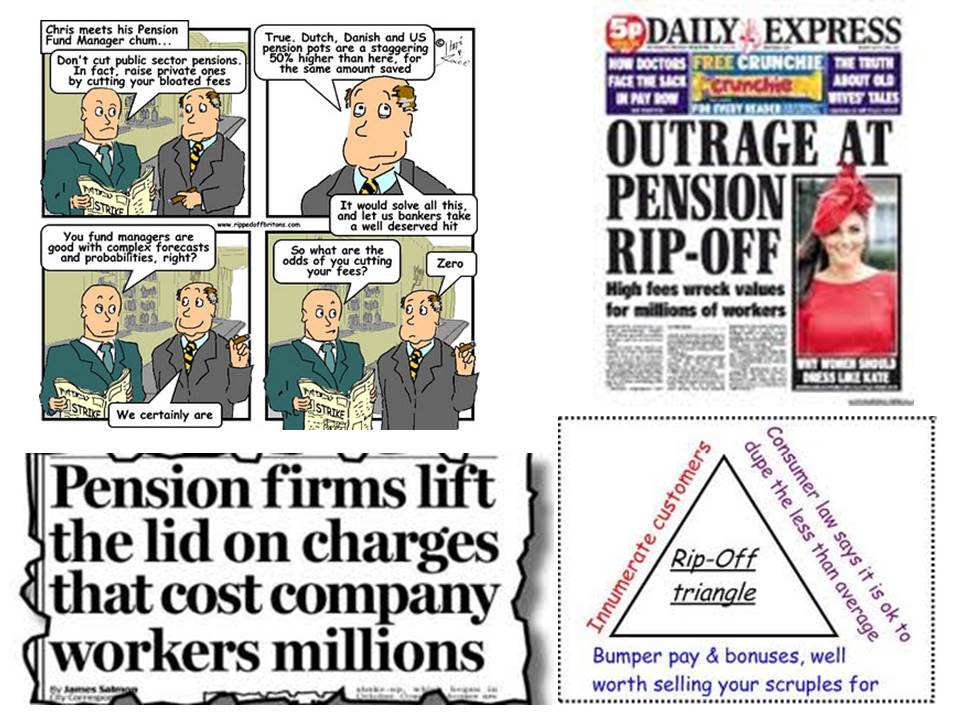

So, we’re all being encouraged to save up for our own pensions. But let me do a little simple maths. On older pension schemes�(taken out before 2001) annual charges are at least 1.5% a year. Actually they’re a lot higher, usually over 2%, due to up to 18 hidden charges that most of us don’t know about. But let’s just assume people are paying a seemingly modest 1.75% a year.

If you’re saving for 40 years, then on your first year’s contribution, you’ll be paying 70% (40 years x 1.75%) to your pension fund manager. On your 2nd year’s contributions, you’ll be paying 68.25%. On your third year’s contributions – 66.5% and so on . So you might be tempted to wonder whose pension you are paying into – your own or that of your pension fund manager (click to see picture more clearly)

If you can bear a few more figures, let’s do some more maths. If you pay �5,000 a year (including your contribution, your employer’s contribution and your tax rebate) into a pension scheme for 40 years and the scheme achieves growth of 2% a year above inflation, by the time you retire you’ll have around �147,470, but you’ll have paid about �59,400 to your lucky pension fund manager.

Now let’s compare Britain’s rip-off pension industry with Denmark, Holland, Australia and many other countries. Annual charges on their pension schemes are in the region of 0.3% to 0.5%. According to my calculations, if you were paying 0.5%, then from your �5,000 a year for 40 years, you’d have about �275,000 for yourself and would have paid your pension fund manager just �25,500.

Thus, because of the extraordinary power of compounding interest over the years,�the slightly lower charges of these other countries would have given you a pension pot about �127,530 larger than the same savings would have given you in rip-off Britain. Just that small difference in fees from Britain’s 1.75% to other countries’ 0.5% would have left you with over 86% (�275,000/�147,470) more in pension savings.

Are you being fleeced by Britain’s rip-off pensions industry? Yes you are!

(Tomorrow financial services lie No. 5 – “Saving in a SIPP (Self-Invested Personal Pension) is a low-cost way of saving for your retirement”. Then I’ll go back to political stuff as, to my disappointment,�the number of people reading this site is collapsing as many former readers appear to have no interest at all in how they are being ripped off by the financial services industry. That will make financial industry insiders very happy indeed)

Australia went through the trials and tribulations that the UK is going through now. Stories of high fees and charges, were numerous, together with companies ‘investing’ pension funds in failing businesses, and pensions never to be seen again. Greed always gets in the way David, and when these avaricious bas*%%%* have made their millions someone will put it right, hopefully.