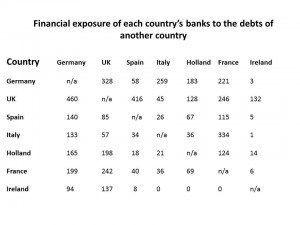

The chart below shows the exposure of�banks in a few key European countries to the debts of other countries (in $bn).

You should read the chart�like one of those old-fashioned�tables of distances between towns that we used to use before we all got satnavs. Here you should work vertically, then horizontally. So, for example, Germany’s banks are exposed to $460bn of UK debt, while British banks are exposed to $328bn of German debt.

Similarly,�French banks are exposed to �$115bn of Spanish debt, while Spanish banks are exposed to $40bn of French debt. And UK banks are exposed to $198bn of Dutch debt while Holland’s banks are exposed to $128bn of UK debt. And, ludicrously, bankrupt Spain’s banks are exposed to $34bn of bankrupt Italy’s debts, while bankrupt Italy’s banks are exposed to $26bn of bankrupt Spain’s debt.

Similarly,�French banks are exposed to �$115bn of Spanish debt, while Spanish banks are exposed to $40bn of French debt. And UK banks are exposed to $198bn of Dutch debt while Holland’s banks are exposed to $128bn of UK debt. And, ludicrously, bankrupt Spain’s banks are exposed to $34bn of bankrupt Italy’s debts, while bankrupt Italy’s banks are exposed to $26bn of bankrupt Spain’s debt.

So what does this all mean? It means that the slightest wobble in any major European country will bring the whole of Europe’s banking system�tumbling down with such a mighty�crash that it will be heard from outer space. This is why the EU cannot allow any country to default or any major bank to implode. This interconnectedness of debt between many mostly bankrupt countries could lead one to describe the whole European economy as a “house of cards in the face of a hurricane”. But, a house of cards in the face of a hurricane actually appears quite solid compared to the European countries’ dependence on each other not defaulting.

This is the first time these figures have ever been revealed in such a horrifyingly simple format�- aaaaaarrrrrrgggggghhhhhhhhhh!

Still, at least the Aussies can laugh at Europe’s debt house of cards: “How can broke economies lend money to other broke economies who haven’t got any money because they can’t pay back the money the broke economy lent to the other broke economy and shouldn’t have lent to them in the first place because the broke economy can’t pay it back?” Enjoy http://www.youtube.com/watch?v=I5QwKEwo4Bc&feature=relmfu

(Btw I’d be grateful for your support for this website if you would buy some copies of my latest book GREED UNLIMITED)

Gosh!

If one nets off the owed/owes for all countries (as I am certain you have done) it shows we in UK owe $385bn, then Italy at $208bn, then Ireland at �78bn and Holland at $52bn.

The most “in credit” is France at a nicely positive bankers bonus of $448bn.

Germany and Spain are pretty well equal on the net owe/owed scale

I suppose the wealthy people often borrow the most so this chart may not show the real wealth of the countries, but it does tend to indicate we are stuffed!

Generally I do not read article on blogs, but I would like to say that this write-up very forced me to take a look at and do so! Your writing taste has been amazed me. Thanks, quite nice article.