Wednesday – Thursday blog

Great celebration for our useless government. Apparently UK inflation is down from 2.8% last month to 2.6% in March 2025 compared to March 2024.

But I suspect that very few people actually know what the inflation (CPI – Consumer Price Index) figures include and what they don’t include.

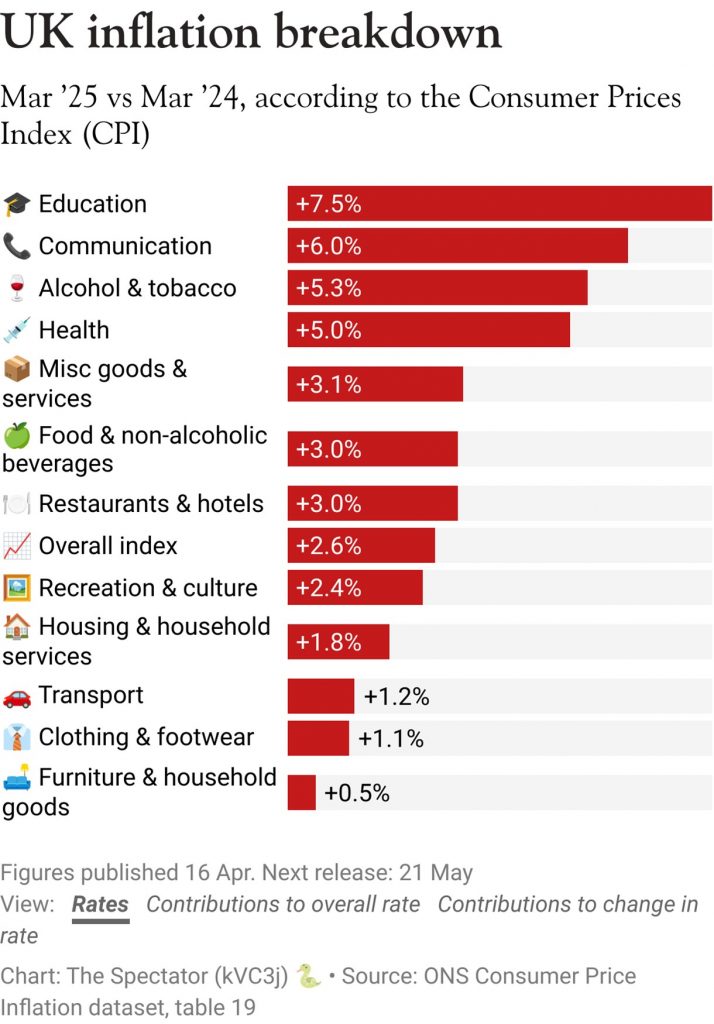

Here’s the structure of the main items in the CPI inflation index:

Looking at the different inflation rates, I struggle to see how they all add up to only a 2.6% rise in the CPI. I guess it must have something to do with the weighting of the various items.

But the real issue for me is that these CPI figures give little idea of the real cost of living increases which are crushing many UK households and businesses. For example, the CPI doesn’t include:

- Council Tax – up by a minimum of 5%. For 2025-26, the government is letting six areas introduce bigger rises. Bradford Council increased bills by 10% and they rose by 9% in Newham, and Windsor and Maidenhead. Birmingham, Somerset and Trafford put bills up by 7.5%

- Water bills – up 26% on average, but up to 47% in some areas

- Electricity and gas – For a typical household paying by Direct Debit for dual fuel, the energy price cap will increase by 6.4% to £1,849 per year

- Rents – In 2024, UK private rents saw an increase of 9.0% in the 12 months to December 2024, with London experiencing the highest rent inflation at 11.5%

- House prices – In 2024, UK house prices experienced a rise of 4.7%. However, this growth wasn’t uniform across all regions. Northern Ireland saw the highest increase at 7.1%, while England’s overall increase was 3.1%. Scotland experienced a 4.4% rise, and Wales saw a 2.7% increase

- Private education – up by 10% to 20%

- Cost of employing someone – National Insurance rates up by 8.7% from 13.6% of salary to 15% of salary and the threshold that employers start paying National Insurance on an employee’s earnings fell from £9,100 to £5,000 a year.

- Business rates – 75% relief on business rates, charged on most non-domestic properties, will continue at a lower rate of 40%.

So, if you’ve got a feeling that your cost of living and your employer’s costs are really rocketing up well above the 2.6% suggested by the latest CPI figures, then you’re right.

As per usual, don’t believe anything our worthless mainstream media tells you.

I don’t agree. Inflation is the printing of money which is not based on production. It devalues the money we have and so we effectively pay more. It has a bigger impact than price increases for other reasons which is what you list. For example, some of the increases listed are due to capital expenditure being needed.

Politicians call price increases inflation to avoid taking responsibility and businesses go along with it as well as a way of avoiding admitting to their failure to manage their business.

The majority of people as well will look for any excuse before accept that if they want reliable service then they have to pay for investment.