With 46,000 people coming to live in Britain every month we need to squeeze ever more people in on our tiny, crowded, increasingly Third World island. So more and more houses are being converted into flats, many older buildings are being demolished and replaced by flats and most new developments consist of flats rather than houses. In fact, many people growing up today will spend their whole adult lives living in flats – having a house will just be a distant childhood memory. This new national flat-ulence will feed the next big financial scandal – rip-off service charges.

In fact, rip-off service charges have already led to some fairly brutal court cases and one company that often seems to be involved is FirstPort (previously known as Peverel).

I think Peverel manage about 200,000 properties, 65,000 of which are retirement flats. Peverel was previously owned by retirement developer McCarthy and Stone, the bulk of whose developments it still manages. According to one newspaper report “Peverel has become notorious for its loaded fees and poor service”.

Peverel�has repeatedly lost rulings at Leasehold Valuation Tribunals (LVTs). It was ordered to refund �730,000 to tenants at the Weekday Cross scheme in Nottingham for excessive service charges. It had earlier been sacked as the managing agents. In another case, about �200,000 had to be repaid. And even the ritzy St George Wharf opposite Parliament, where John Major and Chelsea Clinton were buyers, tried to ditch Peverel and demanded �2.6 million in alleged overcharging at an LVT.

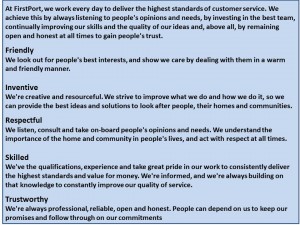

Here are FirstPort’s supposed values (click to see more clearly)

But looking at their actual behaviour, as the person wrote these ‘values’ they must have been guffawing with laughter when they included words like “honest” and “trust”.

Managing agents like Peverel or FirstPort or whatever they are called this week seem to have at least four effective ways of extracting money from the properties they manage:

1. Excessive charges – particularly on retirement flats where charges on a tiny one-bed flat can easily be over �5,000 a year and on a cramped McCarthy and Stone two-bedder around �7,500 a year. In fact Peverel’s charges have often been so high that groups of pensioners have been going to court to throw Peverel/FirstPort out and thus lower the charges they paid

2. Direct fraud – Peverel have been caught assigning maintenance contracts either to companies they own or to preferred, more expensive suppliers thus overcharging residents and then getting a kickback from the higher-priced supplier

3. The on-site manager scam – one widespread practice is to make residents pay for the warden�s (or housekeeper�s) flat at a rate which is astronomically in excess of the real market level. For example, one group of residents found themselves paying �21,500 a year for their warden�s rent when similar flats nearby were only achieving around �12,000 a year

4. Getting a piece of every sale – particularly for retirement flats, companies like Peverel/FirstPort have been demanding a cut (usually 1% to 2%) of the price every time a property is sold. Though I have a feeling this practice may now have been banned

As Britain becomes every more flat-ulent, companies like FirstPort are going to become ever richer as they successfully squeeze money out of tenants and owners who don’t have the time and legal expertise to challenge the management companies lucratively taking them to the cleaners.

Unless there are added extras (that should be clearly costed) such as swimming pools, concierges, wardens etc. no service charges should be over a grand. A sinking fund should be slowly built up each year to pay for regular expensive maintenance work like repainting every 6 years or so and roof repairs when required. The Leasehold Advisory Service are free, knowledgeable and helpful but ultimately the owners of the flats need to be vigilant, collective (residents’ associations) and much more assertive against management company excesses.

In my immediate locality there are two McCarthy & Stone retirement developments currently under construction.

I cannot begin to understand why retired people would want to pay through the nose for a massively overpriced poorly built rabbit hutch, with terrifying service charges.I understand from a good source that the charges in these new developments, and the ground rent, are guaranteed to increase year on year. Very nasty indeed and surely an issue at resale? Also, the leases are not particulary long, which creates issues in the future.

I live in one of the many,original right-to buy scheme maisonettes in my area. These are surrounded by green spaces, mature trees, off street private parking, large private gardens and not overlooked by neighbours in any direction.Typically, these large 3 bed maisonettes have 120 years left on the lease and service charges of no more than �150 a year with �10 ground rent. The local authority are surprisingly efficient to deal with when repairs and the such like are dealt with.Seems to work well with my young family.

Clearly, retirement developers are being plain greedy and milking the older generation for every penny they have.

One idea, which worked well for me, was to purchase the freehold interest via a limited company. This would be one way in which the retired could invest their money well in an older property such as the one described above. This removes all services charges, and adds value to the property.In my case I managed to acquire the freehold interest for about �3k, which was a no-brainier.

It distresses me when i see how quickly these retirement flats seem to sell, when a little thinking outside the box will get the oldies a much better deal long term.

i think some public spirited person should create a website with this article pasted in and the name and future name change of this company repeated lots of times. If we all visited it daily it would go high up when anyone does a google search.

All this companies managed properties should be listed somewhere other than the land register as that is expensive to search.